Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

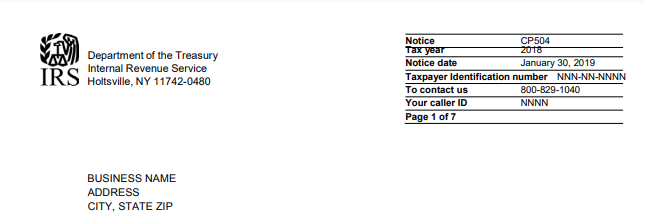

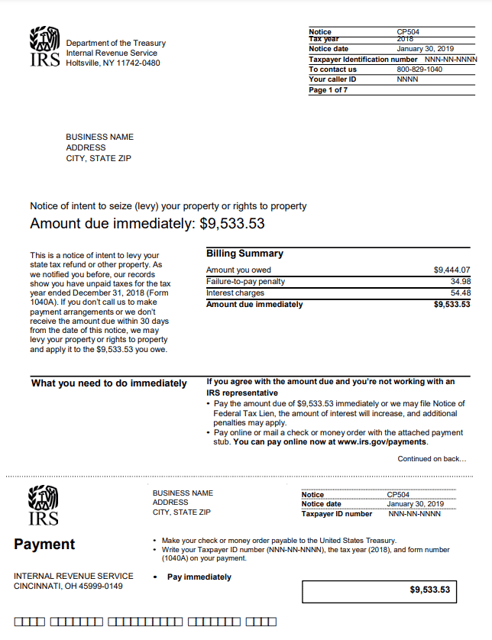

- What is the notice number? CP504

- What government agency sends this notice? The Internal Revenue Service (IRS)

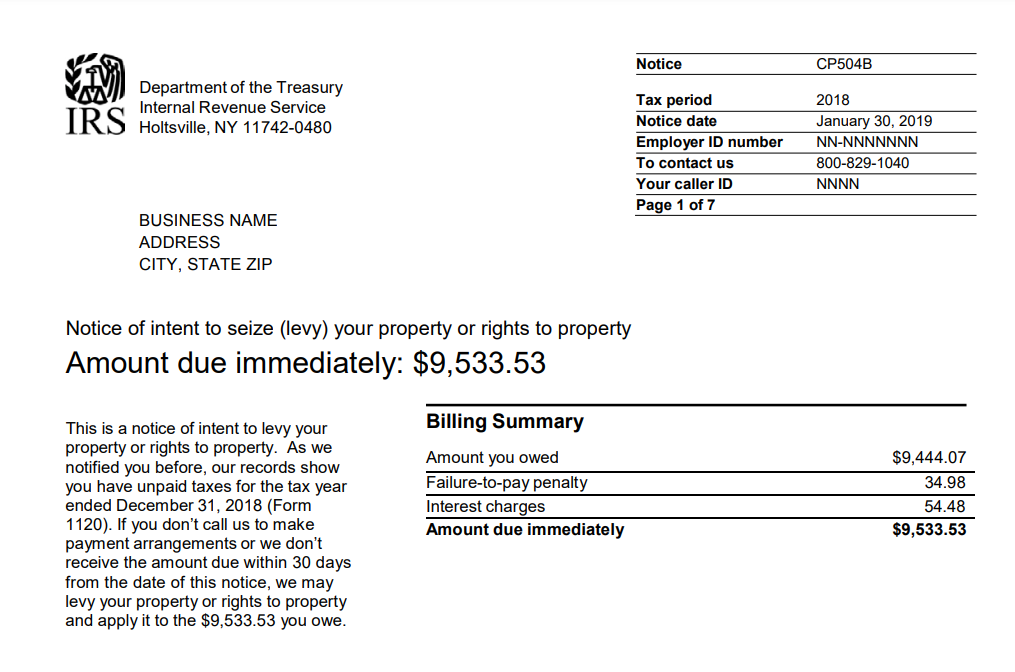

- What is this notice about? You received this notice because the IRS hasn't received payment of your unpaid balance. This notice is your Notice of Intent to Levy (Internal Revenue Code Section 6331 (d)). If you don't pay the amount due immediately, the IRS can levy your income and bank accounts, as well as seize your property or your right to property including your state income tax refund to pay the amount you owe.

- What should you do if you receive this notice?

- Read your notice carefully. It explains how much you owe and your payment options.

- Pay the amount you owe immediately.

- Make a payment plan if you can't pay the full amount you owe.

- Contact the IRS if you disagree by calling the toll-free number shown on your notice.

FAQs & Additional Information

- What is the notice telling me?

- This notice is your Notice of Intent to Levy as required by Internal Revenue Code Section 6331 (d). It is your final reminder telling you that the IRS intend to levy your wages, bank accounts, or your state tax refund because you still have an unpaid balance on one of your tax accounts. It is also telling you that the IRS will begin searching for other assets on which to issue a levy. To avoid this, you must pay the amount you owe immediately.

- The IRS can also file a Notice of Federal Tax Lien if they haven't already done so. A lien is a public notice to your creditors that the IRS has a right to your interests in your current assets and any assets you acquire after the lien is filed; it can affect your ability to get credit.

- This notice also explains the denial or revocation of a United States Passport. The Fixing America’s Surface Transportation (FAST) Act legislation, which generally prohibits the State Department from issuing or renewing a passport to a taxpayer with seriously delinquent tax debt. Additional information on passport certification is available at IRS.gov/passports.

- What do I have to do?

- Pay the amount shown on your notice immediately. You can pay your balance online or mail the IRS your payment in the envelope they sent you. Please include the bottom part of the notice to make sure the IRS correctly credits your account.

- If you can't pay the full amount, pay what you can now and contact the IRS immediately at the toll-free number shown on your notice to see if you qualify for a payment plan (including installment agreements) to pay the remaining balance on your account over time. You can also apply for a payment plan online by using the Online Payment Agreement Tool which is the fastest way to get an installment agreement approved.

- What happens if I don't pay or contact the IRS?

- If you don't pay the amount due immediately or make payment arrangements, the IRS can file a Notice of Federal Tax Lien publicly establishing our priority with your creditors. If the tax lien is in place, you may find it difficult to sell or borrow against your property. The tax lien would affect your ability to get credit ― which may harm your credit rating.

- In addition, the IRS can seize ("levy") any state tax refund to which you're entitled. If you still have an outstanding balance after the IRS seizes ("levies") your state tax refund, the IRS may send you a notice giving you a right to a hearing before the IRS Independent Office of Appeals, if you haven't already received such a notice. The IRS can then seize ("levy") or take possession of your other property or your rights to property. Property includes:

- Wages, real estate commissions, and other income

- Bank accounts

- Business assets

- Personal assets (including your car and home)

- Social Security benefits

- Who should I contact? If you have any questions about the notice, call the IRS at the toll-free number shown on your notice as soon as possible to speak to a customer service representative.

- What if I don't agree or have already taken corrective action?

- If you don't agree, contact the IRS immediately to discuss your matter with a customer service representative. They'll do our best to help you.

- If you have already paid this liability or arranged to pay it with an Installment Agreement, you should still call the IRS at the toll-free number shown on your notice to make sure your account reflects this.

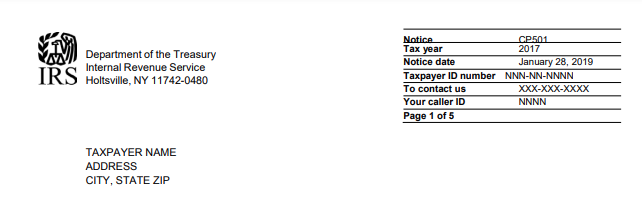

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp504-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp504_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.