Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

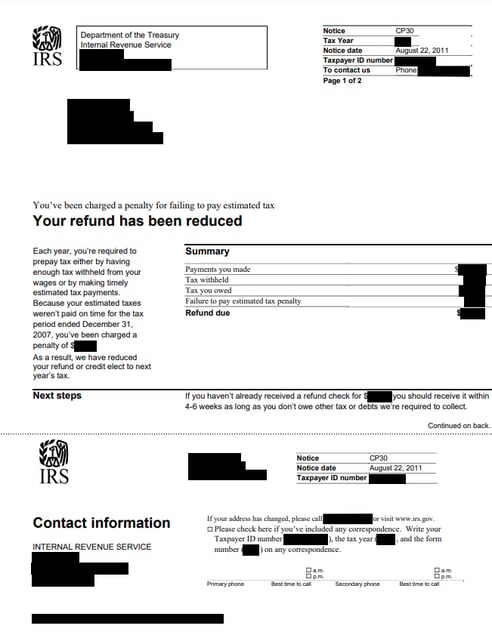

- What is the notice number? CP30

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments. The IRS charged you a penalty for not pre-paying enough of your tax either by having taxes withheld from your income, or by making timely estimated tax payments. You may be charged a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.

- What should you do if you receive this notice?

- Read your notice carefully. It will explain how much you owe and how to pay it.

- Pay the amount you owe by the due date on the notice.

- If your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

FAQs & Additional Information

- You may want to

- Complete Form 2210, if most of the tax withheld from your income was withheld early in the year. Electing to report withholding when it was actually withheld, instead of spreading it equally through the year, may reduce or eliminate the penalty.

- Complete Schedule AI, Annualized Income Installment Method, within Form 2210 if your income varied during the year. You may be able to lower or eliminate the amount of one or more required installments by using the annualized income installment method.

- Request removal of the penalty if you retired in the past two years either because you were 62 or older, or because you became disabled, and you had reasonable cause for the underpayment, or for the late payment of your estimated tax. (See Waiver of Penalty in instructions for Form 2210.)

- Request removal of the penalty if the underpayment, or the late payment of your estimated tax, was due to specific written advice from an IRS agent given in response to a specific written request. You must provide copies of both the written request, and the written advice given in response.

- How do I know if enough is being withheld from my income?

- The IRS' Tax Withholding Estimator can help you determine if enough tax is being withheld.

- How much am I required to pre-pay in order to avoid a penalty?

- Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after filing their return or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is less. There are special rules for farmers and fishermen and Higher Income Taxpayers.

- If your adjusted gross income (AGI) is more than $150,000 ($75,000 if married filing separately) you are required to pre-pay 90% of the tax for the current year or 110% of the tax shown of the return for the prior year, whichever is less.

- Learn more about paying and calculating estimated taxes.

- Estimated taxes are filed on Form 1040-ES, Estimated Tax for Individuals

- Estimated tax payments are generally due on April 15, June 15, and September 15 of the tax year, and on January 15 of the next year.

- Tips for next year

- The IRS encourages everyone to use the IRS Tax Withholding Estimator to perform a quick "paycheck checkup."

- The Tax Withholding Estimator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work.

- There are several reasons to check your withholding:

- Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year.

- Also, with the average refund topping $2,800, you may prefer to have less tax withheld up front and receive more in your paychecks.

- If you are an employee, the Tax Withholding Estimator helps you determine whether you need to give your employer a new Form W-4, Employee's Withholding Allowance Certificate. You can use your results to help fill out the form and adjust your income tax withholding.

- Make timely estimated tax payments, if necessary, to ensure that you pre-pay a sufficient amount of tax though a combination of withholding and estimated tax payments. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, for more details on who must pay estimated tax.

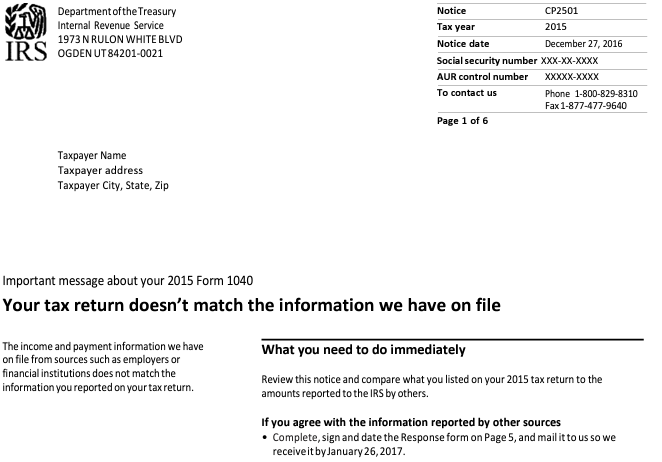

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp30-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp30_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.