Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

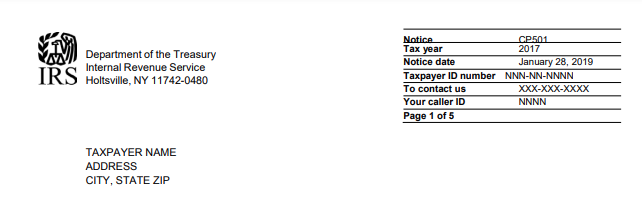

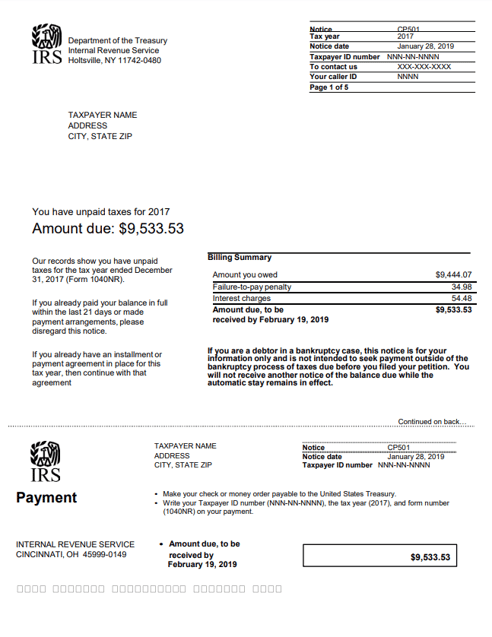

- What is the notice number? CP501

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? You received this notice because you have a balance due (money you owe the IRS) on one of your tax accounts.

- What should you do if you receive this notice?

- Read your notice carefully. It explains how much you owe, when your payment is due, and your payment options.

- Pay the amount you owe by the due date shown on the notice.

- Make a payment plan if you can't pay the full amount you owe.

- Contact the IRS if you disagree by calling the toll-free number shown on your notice.

FAQs & Additional Information

- What is the notice telling me? This notice is a reminder that you owe a balance on one of your tax accounts. You received this notice because the IRS hasn't received your payment or a response to the previous notice requesting you pay this balance.

- What do I have to do?

- Pay the amount you owe by the due date shown on the notice. You can quickly and easily pay your balance online or mail your payment in the envelope the IRS sent you. Please include the bottom part of the notice to make sure it's correctly credited your account.

- If you can't pay the whole amount now, you may qualify for a payment plan (including installment agreements) by applying online through the IRS' online payment agreement application.

- What should I do if I disagree with the changes you made? If you disagree with the changes, call the IRS immediately at the toll-free number shown on your notice. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

- What happens if I don't pay or respond to this notice?

- If you don't pay the amount due, make payment arrangements, or contact the IRS at the toll-free number on your notice, they'll can file a Notice of Federal Tax Lien. A lien is a public notice to your creditors that the government has a right to your interests in your current assets and any assets you acquire after we file the lien; it can affect your ability to get credit.

- In addition, interest will accrue on the unpaid amount and additional penalties may apply.

- Am I charged interest on the money I owe? Yes. The IRS will charge interest on underpayments and overpayments on any outstanding balance until the amount is paid in full. See the "Your Bill Summary" section on your notice for the total interest charged.

- Will I receive a penalty if I can't pay the full amount? Yes, you'll receive a late payment penalty. You can call the IRS at the toll-free number on your notice if you can't pay the full amount or you can apply online for a payment plan (including installment agreements). Contact the IRS by your payment's due date, and depending on your situation, they may be able to remove the penalty.

- What if I need to make a correction to my tax return? You'll need to file Form 1040-X, Amended U.S. Individual Income Tax Return.

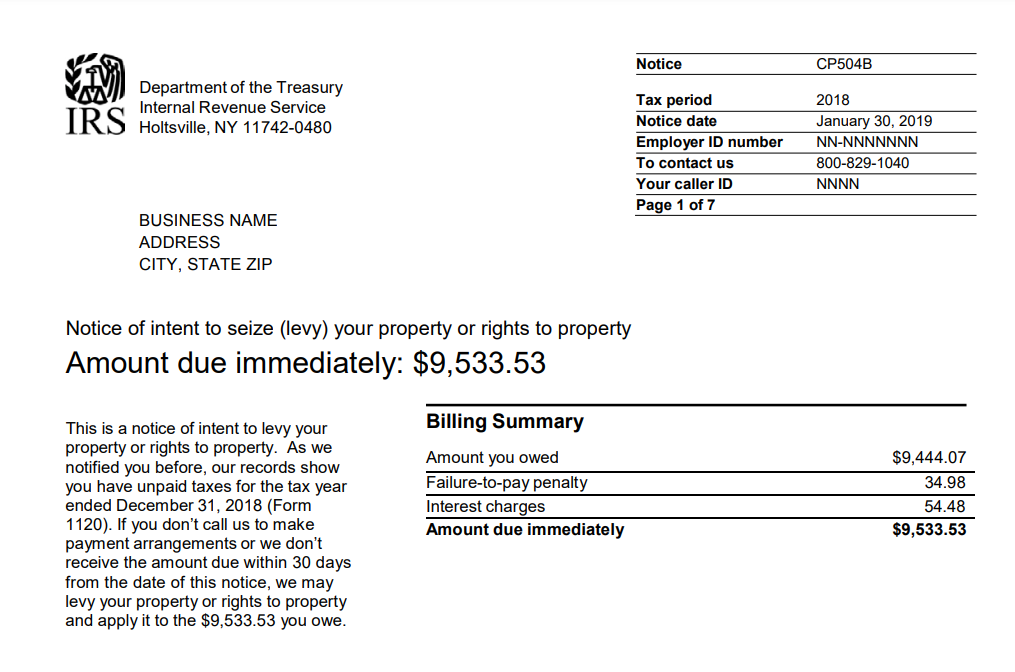

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp501-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp501_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.