Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

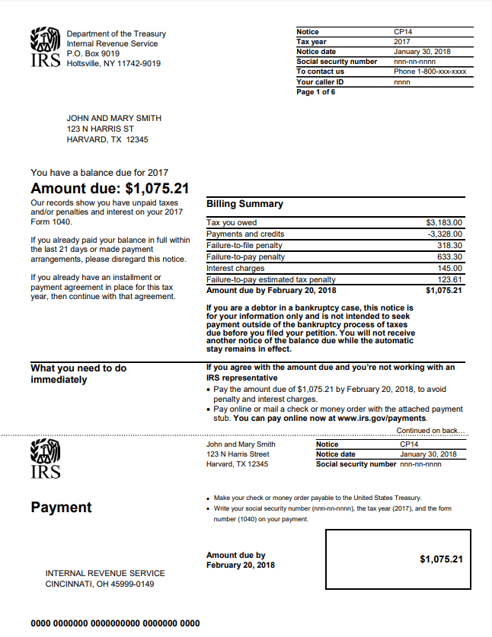

- What is the notice number? CP14

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? The IRS sends you this notice because you owe money on unpaid taxes

- What should you do if you receive this notice?

- Read your notice carefully. It will explain how much you owe and how to pay it.

- Pay the amount you owe by the due date on the notice.

- Make a payment plan if you can't pay the full amount you owe.

- Contact the IRS if you disagree.

FAQs & Additional Information

- What if I live in a disaster area? If your address of record is located in a federally declared disaster area, you should have received a separate Disaster Relief Notice with your CP14 Notice. This means you have additional time to file your tax return and to make your payment listed on the CP14 Notice. You do not need to contact the IRS to get this extra time to pay; it is automatic. To determine your filing and payment due date, visit IRS.gov/disastertaxrelief to locate your specific state and county by disaster area.

- What happens if I can't pay or pay the full amount I owe now? You can apply online for a payment plan (including installment agreements).

- What should I do if I disagree with the notice? Call the phone number located in the IRS Help section of your notice. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

- Am I charged interest on the money I owe? Not if you pay the full amount you owe by the date on the notice. However, interest accrues on the unpaid amount after that date

- Will I receive a penalty if I can't pay the full amount? Yes, you'll receive a late payment penalty. You can call the IRS at the number on your notice if you can't pay the full amount or you can apply online for a payment plan (including installment agreements). Contact the IRS by your payment's due date.

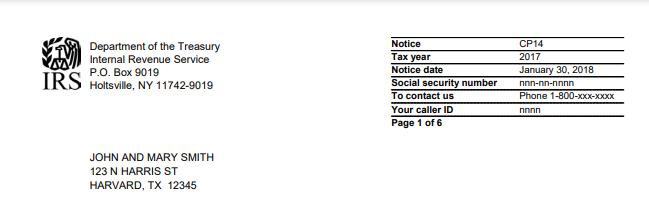

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp14-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp14_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.