Understanding the purpose of a tax form or schedule is never a pleasant experience. That's why we created a comprehensive tax form library, showcasing the most frequently used tax forms and schedules you may encounter. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

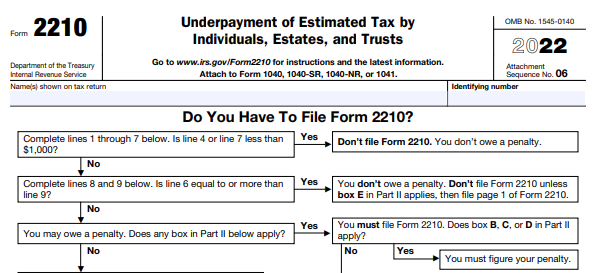

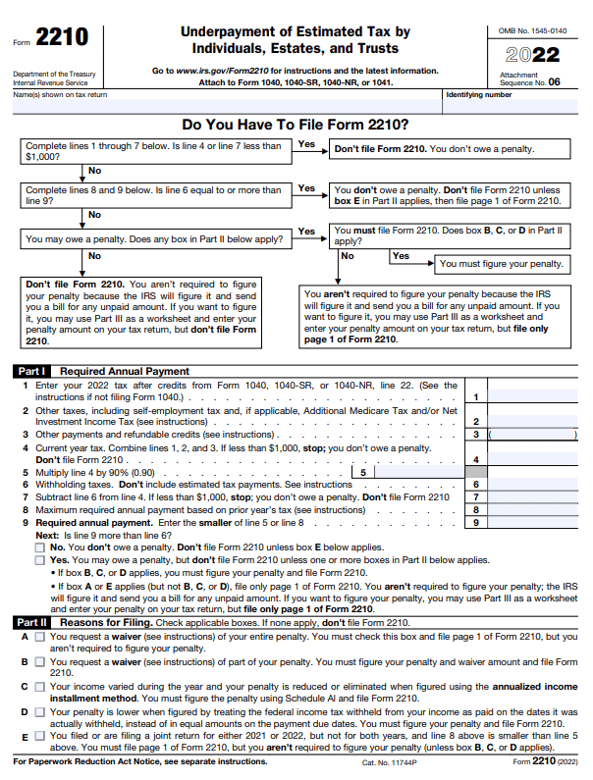

- What is the form number? Form 2210

- What government agency is it filed with? The Internal Revenue Service (IRS)

- What is the form name? Underpayment of Estimated Tax by Individuals, Estates and Trusts

- What is this form about? Form 2210 is a document used by individuals to determine if they owe a penalty for underpaying their estimated tax. This form calculates any penalty due based on the difference between the amount of tax that was paid throughout the year (through withholding or estimated tax payments) and the individual's total tax liability. By completing this form, individuals can ensure they are accurately addressing any underpayment issues and related penalties.

What does it look like?

Resources

Looking for more information about this form? Here are some helpful resources:

- About the form - https://www.irs.gov/forms-pubs/about-form-2210

- Example copy of the form - https://www.irs.gov/pub/irs-pdf/f2210.pdf

- Form instructions - https://www.irs.gov/pub/irs-pdf/i2210.pdf

How can we help you today?

Looking for more information about this or other tax forms? The tax team at DiMercurio Advisors are tax compliance experts. We are passionate about ensuring you are well-informed and in control of your tax situation.