You can pay your taxes online in a few quick and easy steps with Direct Pay.

The IRS estimates that business owners spend an average of 22 hours filing their tax return. Luckily, it only takes a few minutes to actually pay your taxes online.

If you're a business owner and you don’t have an IRS account yet, now is the time to make one! The simplest way to pay your taxes is through that account with Direct Pay. It’s an easy-to-use portal any taxpayer could use to pay income taxes, estimated taxes and more.

Follow these five easy steps to pay your taxes for this year – or prior years.

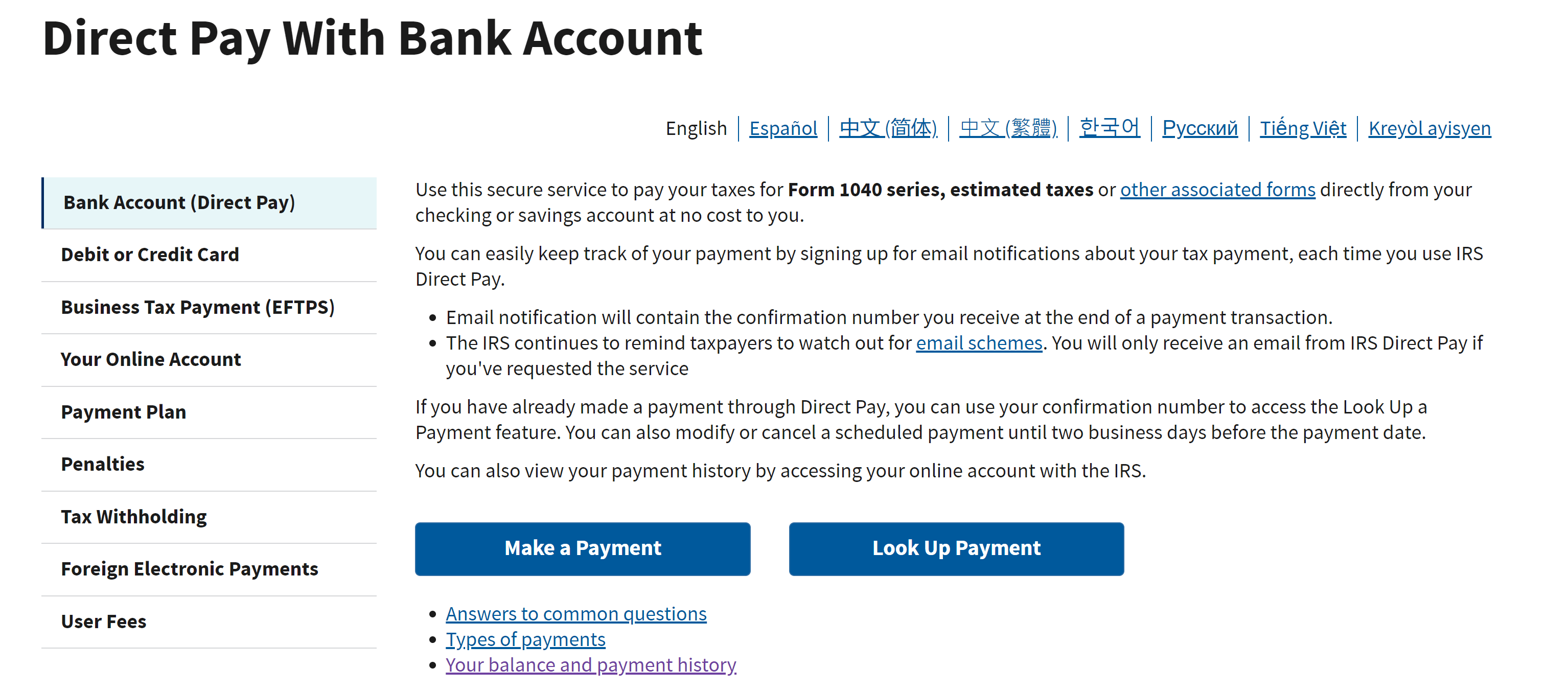

Step 1: Visit the IRS Direct Pay page

The first page you need to visit is IRS.gov/payments/direct-pay. There, you can choose whether you’d like to make a payment or look up a payment.

If you have any general questions like what payment methods you can use, how to make a payment for your spouse or how to verify your identity, you can select the “Answers to common questions” link.

Once you select “Make a Payment,” head to step two.

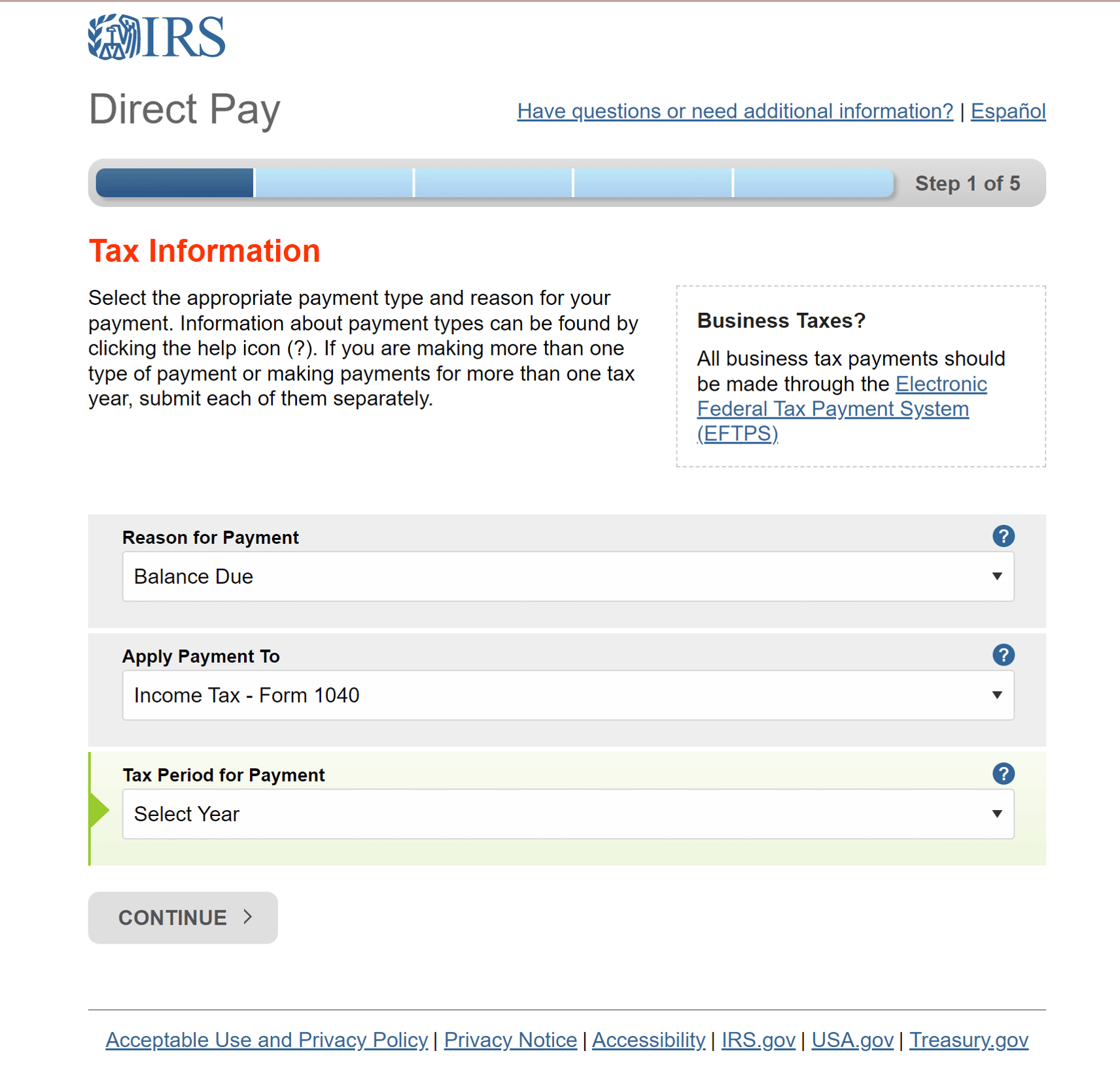

Step 2: Enter your tax information

Next, you’ll select your reason for payment, what type of payment you’d like to make and the tax period you’re making it for.

The most common reasons you’ll make a payment are for a payment plan or installment agreement, a balance due or estimated taxes.

Then you’ll need to apply your payment to your Form 1040. Select what tax year you’d like to pay and select continue.

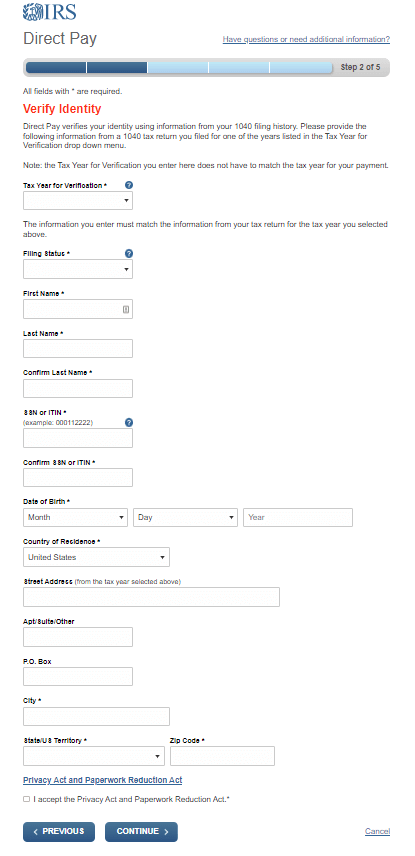

Step 3: Verify your identity

The IRS will ask you to fill out a form that serves to verify your identity.

Enter a tax year for verification. This doesn’t have to be the current year – or even the year you're making a payment for. Just select the year you last filed your return.

Make sure the information you put on the rest of the form matches the tax year you entered for verification. That’s important to remember because that may not necessarily match your current address or filing status.

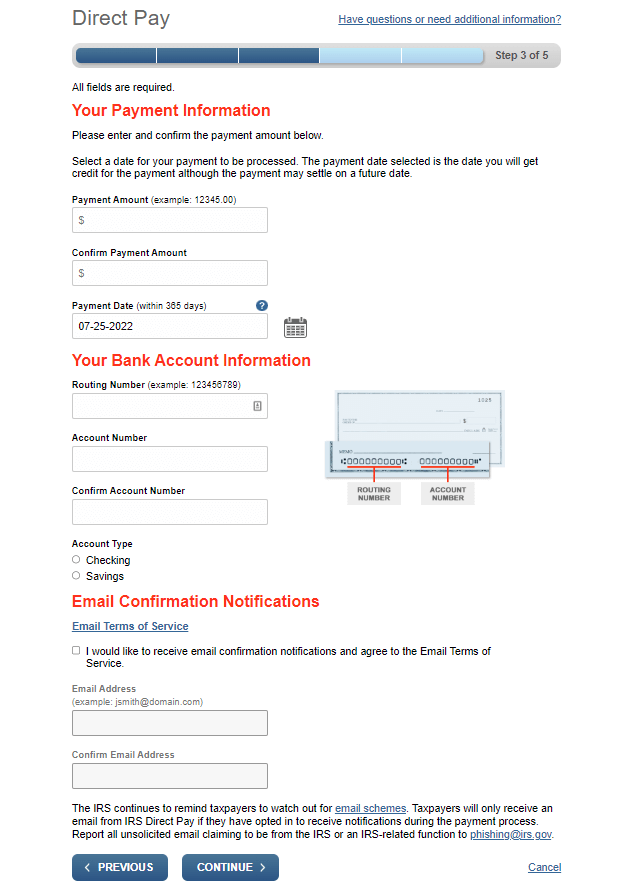

Step 4: Enter your payment information

The next screen will ask you for three things: your payment information, bank information and your email.

You’ll select your payment amount and the date the payment will be credited to. Note that this may not necessarily be the date the payment goes through. You can schedule it for today – or for the appropriate tax deadline.

Enter your bank account information and mark its type as either checking or savings.

Next, you should opt to receive an email confirmation that your payment has been scheduled. The more documentation you have of any tax filings or payments, the better.

Step 5: Confirm your information and submit it to the IRS

After that, you’re pretty much set. Just make sure all your information looks correct and you’re ready to submit your payment using Direct Pay.

To make payments in the future even faster and easier, consider creating an IRS account. Most of your information will be stored on there already – so you can save some extra time entering information.

The bottom line

Paying your taxes with the IRS’s Direct Pay option is one of the fastest and easiest ways to pay your taxes.

It only takes a few steps and a few minutes with an online form. If you want to make it even easier, create an IRS account and make payments on your balance or payment plan from there.

Want to lower how you pay the IRS every year or every quarter? Schedule a free call with a DiMercurio Advisors team member today. As a business owner, strategic tax planning with a CPA can leave you with more money to invest in your business – and make paying your taxes a lot less painful.