You can owe more in penalties — or even have your assets seized — if you don’t pay your taxes. Here’s what to do if you can’t afford to pay all of your taxes to help you avoid that.

The IRS won’t come knocking on your door if you’re a day late to paying your taxes. But if a few years go by and you haven’t made any effort to pay them, then the IRS may consider seizing your assets.

Thankfully, there’s a lot you can do before then to help you pay off your tax debt and stay in good standing with the IRS. Your best option is to get on a payment plan, but there are other options like debt settlement and payment extensions you might qualify for.

Find out what your options are below and how they might affect you and your business. You can decide for yourself, but it’s always best to talk to a tax expert before you make any decision.

What happens if I don't pay my taxes?

The consequences for not paying your taxes depend on how much you owe and how behind you are with paying them. Here are some of the most common consequences and when they happen:

- You’ll owe penalties and interest. The failure-to-pay penalty is 0.5% of your unpaid taxes each month up to 25% of your unpaid taxes. Interest also accumulates daily and doesn't have a cap.

- The IRS can freeze your bank accounts. If you don’t pay your taxes, you won’t be able to touch a certain amount from your bank account. For example, if you owe $10,000 in taxes and you have $15,000 in your account, then the IRS could freeze the $10,000 in your account so you can’t spend more than $5,000 until your taxes are paid. The rules and limits may differ by situation.

- The IRS can place liens on your assets. If the IRS places a lien on your assets, that means they can prevent you from earning income on or selling it — but they won’t necessarily seize it from you. For example, if the IRS places a lien on your home, you won't be able to sell it without discussing the sale and the amount due to the IRS first. Liens are also publicly available on your county’s website, so anyone could see that you owe tax debt.

- You might be forced to sell your assets. You may be forced to sell assets to the IRS — including ownership of your business.

Steps you can take if you can’t afford your tax bill

The statute of limitations for federal tax debt is generally 10 years from the later of two dates: the tax due date of the year it’s due or when you file your return. That means that after 10 years, you no longer owe those taxes.

But you should never wait for the clock to run out. That can affect your credit score and ability to get loans and funding as a small business owner.

Instead, you should opt for one of the payment methods below. The most popular of them is applying for an IRS payment plan. Tax debt is normal for business owners — and so are payment plans. There’s no shame in them, and they let you stay out of trouble with the IRS without paying a huge chunk of cash at once.

The IRS just wants you to have a plan to pay your debt — so find out which option is best for you.

1. Apply for an IRS payment plan

An IRS payment plan allows you to make your tax payments over time. You likely qualify for an individual payment plan if you owe less than $100,000 in taxes, your business is a pass-through entity and your tax returns are up to date. This is usually the best option for business owners.

There are business and individual plans available, but most small business owners qualify for individual plans if their businesses are pass-through entities. That means that for tax purposes, you’re no different from your business — like LLCs taxed as sole proprietorships, partnerships and S corps.

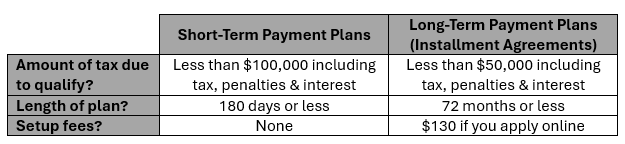

There are short- and long-term payment plans depending on how much you owe. Here’s what you need to know about each:

In general, small business owners should opt for long-term payment plans. You might think that larger payments on a short-term plan are manageable or want to get your tax debt over with. But long-term payment plans with smaller payments are potentially better for your cash flow. You might make a big purchase one month or an emergency might happen, leaving you unable to make your larger payment.

Interest will still accrue while you’re on any type of payment plan — but it’s a lot easier to bring your balance down and lower how much interest you accrue when you stick to a payment plan.

2. Pay what you can on Tax Day

If it comes Tax Day and you don’t have a plan to pay your taxes, just pay what you can.

But this is not a long-term solution. It only buys you a little more time to find a plan that works for you. After Tax Day, you’ll owe a failure to pay penalty on the taxes you haven’t paid and interest on what you still owe.

By paying what you can by Tax Day, you can lower your penalty amount and lower how much your interest you accrue. You would need to find a long-term plan soon after Tax Day since interest accrues daily.

3. File a request for payment extension due to hardship

Form 1127 allows you to request for a payment extension. Traditional tax extensions are only an extension to file — not to pay. Form 1127, on the other hand, does let you request a payment extension. However, you can only qualify if paying your taxes would cause you significant financial hardship.

These are hard to get approved for because of that requirement. But if you do get approved, you’ll receive a 6-month extension. You would need to file for an extension by the tax deadline.

Unless you’re going through financial struggles, this shouldn’t be a top option for you.

4. Request Currently Not Collectible status

You can delay the collection process temporarily by applying for Currently Not Collectible (CNC) status. Your debt doesn’t go away and you still owe penalties and accrue interest. However, the IRS won’t actively try to collect your debt through levies, which are seizures of your assets.

In order to qualify for CNC status, you have to prove that paying your taxes would cause you serious hardship. This is primarily for people with little to no income. The IRS will ask you for proof of this by looking at your financials.

With CNC, the IRS can withhold your tax refunds and use them to pay down your tax debt.

According to the IRS, the only way to request CNC status is by contacting the IRS directly. Call the IRS at 800-829-1040 or the number on your bills or tax notices to request CNC status.

5. Apply for an Offer in Compromise

An Offer in Compromise is basically debt settlement for your taxes — you pay off your debt for less than what you originally owed. For example, if you owe $100,000 in taxes including penalties and interest, you can remove all your debt by just paying $70,000 with an Offer in Compromise.

That may sound ideal, but it’s not. When you receive an Offer in Compromise, you lose access to tax credits and benefits — and the agreement is publicly available.

A few of the main ways to qualify for this include proving to the IRS that paying taxes in full would cause you economic hardship or if the IRS doubts your ability to pay the full amount. If you do meet one of those criteria, you also need to be fully up-to-date on filing your tax returns.

You can pay your Offer in Compromise in a lump sum, or make payments over time on it. In order to be approved for an Offer in Compromise, you must include 20 percent of your offer amount and a $205 application fee.

The bottom line

There’s no need to panic if you can’t afford to pay your taxes in full by Tax Day. It’s a normal thing — especially for small business owners.

Luckily, there are several options to help you pay your taxes regardless of your situation. The best option in most cases is to apply for a payment plan to help you get on track to pay your taxes eventually. There are also options for people in dire straits, like requesting Currently Not Collectible status or an Offer in Compromise.

As a small business owner, your tax decisions affect both you and your business. That’s why you should consult a tax expert before you make any big tax decisions — with this being one of them. Schedule a free call with a DiMercurio Advisors team member for help deciding which payment method is best for you.