Let’s be honest—payroll might not be the most thrilling part of running a business, but it’s definitely one of the most important. Payroll reports are like your financial GPS, guiding you through employee wages, tax withholdings, and other deductions. They’re essential for staying compliant, avoiding costly mistakes, and keeping your business on track.

For small business owners, payroll reports are a must-have during tax season. They provide the data your CPA needs to file accurate returns and ensure you’re meeting state and federal requirements. And the best part? When you know how to access these reports quickly, you can save time, reduce stress, and make tax season a whole lot smoother.

In this guide, we’ll walk you through how to pull a payroll report from Gusto—step by step. Whether you’re a Gusto pro or just getting started, you’ll be exporting reports with confidence in no time.

Contents |

| What is a payroll report? |

| Why is my CPA asking for it? |

| How do I pull a payroll report from Gusto? |

| Is a payroll report different than a W-3? |

What is a payroll report?

A payroll report is a document that summarizes payroll-related information for a specific period. Think of it as a snapshot of your business’s payroll activity—it shows how much you’ve paid your employees, the taxes you’ve withheld, and other important details.

Here’s what you’ll typically find in a payroll report:

- Employee wages and salaries: The total amount paid to employees before any deductions.

- Taxes withheld: Federal, state, and local taxes deducted from employee paychecks.

- Employer-paid taxes: These are taxes your business is responsible for paying, such as the employer’s share of Social Security and Medicare.

- Deductions: Amounts withheld for benefits, retirement contributions, or other purposes.

- Net pay: This is the amount employees take home after all deductions and taxes are subtracted from their gross pay.

Types of Payroll Reports

Not all payroll reports are the same. Depending on your needs, you might use one of these common types:

- Payroll Summary Report: Provides an overview of payroll totals for a specific period, such as total wages, taxes, and deductions.

- Payroll Detail Report: Lists individual employee earnings, taxes, and deductions, giving you a more granular view.

- Tax Liability Report: Shows the taxes your business owes for a specific period, helping you stay on top of your tax obligations.

- Workers’ Compensation Report: Summarizes wages for workers’ compensation insurance purposes, ensuring you’re properly covered.

Example of a Standard Payroll Report

A typical payroll report might include columns for:

- Employee names

- Hours worked

- Gross pay (the total amount earned before deductions)

- Taxes withheld (federal, state, and local)

- Net pay (the amount employees take home after taxes and deductions)

At the bottom, you’ll usually find totals for each category, giving you a clear picture of your payroll expenses for the period.

Why is my CPA asking for it?

Your CPA isn’t just asking for payroll reports to keep give you more work—they’re a critical tool for keeping your business compliant and your finances in order. Here’s why your CPA needs them:

Tax Filing

Payroll reports provide the data needed to file federal, state, and local payroll taxes accurately. Without them, your CPA would be left guessing—and that’s a recipe for errors or penalties.

State Tax Obligations

If your employees work in multiple states, payroll reports help your CPA determine which states you owe taxes in. This is especially important for remote teams or businesses with employees who travel for work.

Compliance

Payroll reports ensure your business complies with labor laws and tax regulations. They’re your proof that you’re paying employees correctly and meeting your tax obligations.

Financial Planning

The data in payroll reports can help identify trends, such as rising labor costs or seasonal fluctuations, and inform smarter budgeting decisions.

Imagine this:A small business owner with remote employees in three different states forgot to provide payroll reports to their CPA. When tax season rolled around, the CPA discovered that the business owed taxes in two additional states—something that could have been avoided with timely access to payroll reports. Not only did the business face penalties, but the owner also had to scramble to gather the necessary data. 💡By providing payroll reports upfront, you can avoid situations like this and make tax season smoother for everyone involved. |

How do I pull a payroll report from Gusto?

Pulling a payroll report from Gusto is a straightforward process. Here’s how to do it step by step:

Step 1: Log into Your Gusto Account

Start by signing into your Gusto account using your username and password.

Step 2: Navigate to the Payroll Reports Section

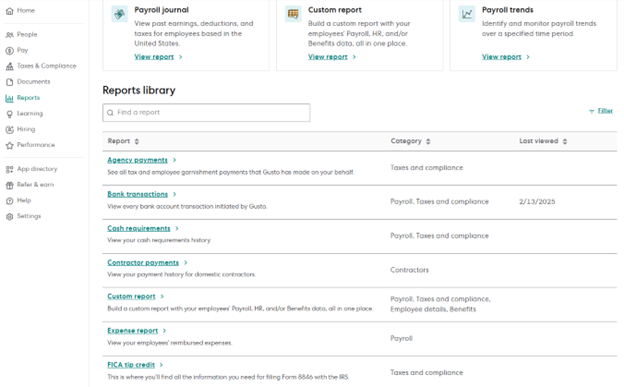

From the dashboard, click on the Reports tab in the left-hand menu.

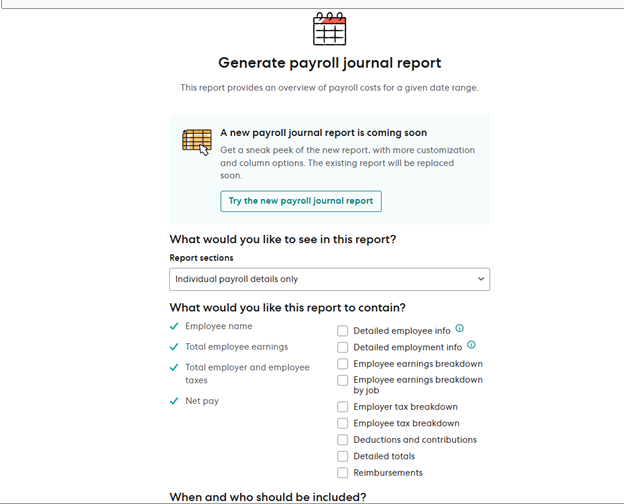

Step 3: Select the Necessary Report

Choose the type of payroll report you need. Common options include:

- Agency Payments

- Bank Transactions

- Contractor Payments

- Expense Report

- Federal Tax Documents

*For a more detailed list of reports available in Gusto please check THIS GUIDE.

Step 4: Create a Custom Report (Optional)

If you need a report tailored to your specific needs, you can create a custom report in Gusto. Here’s how:

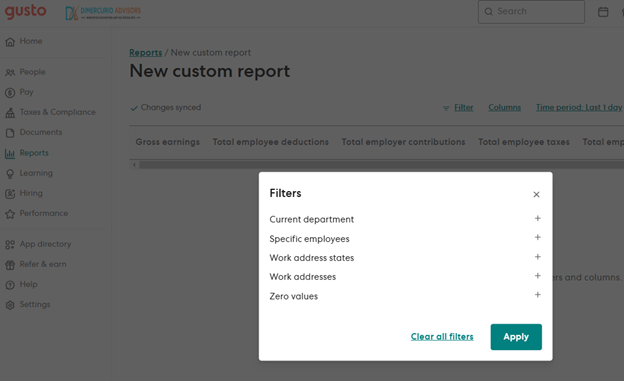

- Select “Custom Report”: From the Reports page, choose the Custom Report option.

- Break Down the Data: Use the “Break down by” field to structure your report by payroll, employee, or work address. You can combine and reorder these fields to get the exact view you need.

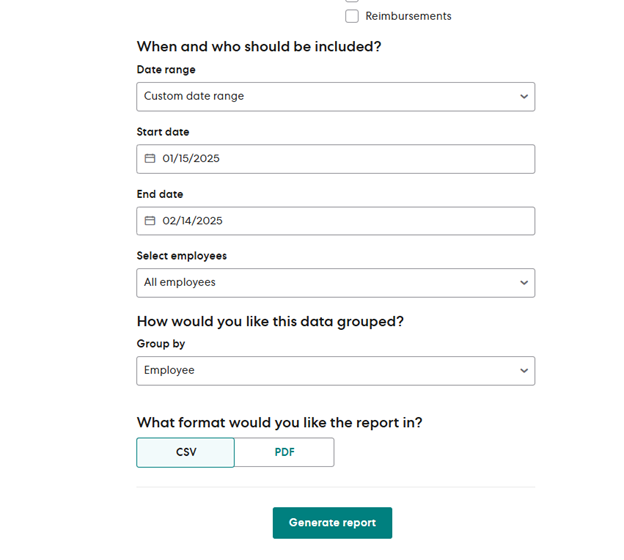

- Set the Time Period: Use the “Time period” field to define the scope of your report. You can:

-

- See a snapshot of your data on a specific day.

- Pull data between two dates.

- Select specific payrolls to include.

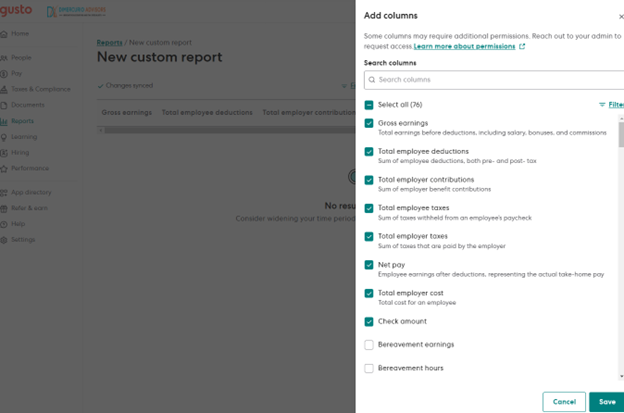

- Add Custom Columns: Customize your report by adding specific columns, such as:

-

- Gross earnings

- Total employee deductions

- Total employer contributions

- Total employee taxes

- Total employer taxes

- Net pay

This allows you to include only the data that’s relevant to your needs.

Step 5: Save as Payroll Journal Report and Export as CSV

Once you’ve customized your report, you can save it as a Payroll Journal Report—a detailed report that’s vital for your CPA. It provides a comprehensive breakdown of payroll information for each pay period and employee, making it easier to reconcile payroll expenses and ensure accurate financial reporting.

Here’s how to save and export the report:

- Save as Payroll Journal Report: After customizing your report, click Save as Template and name it (e.g., “Payroll Journal Report”). This allows you to reuse the report in the future without rebuilding it.

- Export as CSV: Click the Download button and select CSV as the format. CSV files are ideal for data analysis and sharing with your CPA, as they’re easy to manipulate and import into accounting software.

Pro Tips for Exporting Reports

Pro Tips for Exporting Reports

- Choose CSV Over PDF: CSV files are more versatile and easier to work with, especially for data analysis and sharing with your CPA.

- Schedule Regular Report Pulls: Set a reminder to pull payroll reports quarterly or ahead of major deadlines. This ensures you’re always prepared and avoids last-minute scrambling.

- Bookmark the Reports Page: Save time by bookmarking the Reports page in your browser for quick access in the future.

Is a payroll report different than a W-3?

If you’re new to payroll and taxes, you might wonder how a payroll report differs from a W-3. While both are important for managing your business’s finances, they serve different purposes and are used in different scenarios.

What’s a payroll report?

A payroll report is a detailed breakdown of your payroll activity for a specific period. It includes information like employee earnings, taxes withheld, deductions, and net pay. Payroll reports are internal documents used for tracking payroll expenses, reconciling accounts, and providing data to your CPA.

What’s a W-3?

A W-3 is an official tax form that summarizes all the W-2s you’ve issued for the year. It includes the total wages paid, federal income tax withheld, and other payroll taxes. The W-3 is filed with the Social Security Administration (SSA) and is used to report your business’s annual payroll information to the government.

Key Differences

|

Payroll Report |

W-3 |

|

Internal document for tracking payroll |

Official tax form filed with the SSA |

|

Detailed breakdown by pay period |

Summary of all W-2s for the year |

|

Used for financial analysis and CPA |

Used for annual tax reporting |

When is each required?

- Payroll Report: Use payroll reports throughout the year to track payroll expenses, reconcile accounts, and provide data to your CPA.

- W-3: File the W-3 annually, along with copies of all W-2s, by January 31st of the following year.

The bottom line

While payroll reports might not be the highlight of your day, they’re a crucial part of keeping your business on track. By following these simple steps, you can easily pull the reports your CPA needs to file your taxes accurately and keep your business compliant.

Here’s a quick recap of how to pull a payroll report from Gusto:

- Log into your Gusto account

- Head to the Reports section

- Choose the report you need

- Customize it to fit your needs, if necessary

- Save and export it as a CSV file for easy sharing

Making it a habit to pull payroll reports regularly—whether quarterly, monthly, or before tax deadlines—can save you time, reduce stress, and keep your finances organized. It’s one of those small tasks that pays off big in the long run.

And remember, you don’t have to figure it all out on your own. If you’re stuck or just want to make sure you’re on the right track, schedule a free call with a DiMercurio Advisors team member today. We’re here to help you every step of the way!

Need More Help? Check Out Gusto’s Official Guide

If you’d like to dive deeper into Gusto’s reporting features, check out their official guide: View and Download Reports in Gusto. It’s a great resource for understanding all the reporting options available and how to make the most of them.