It’s time to file your tax return and you’re missing your W-2s. Now what?

If Tax Day is approaching and you haven’t received your W-2s or 1099s, you might think you’re out of luck. But there’s a solution for that: Form 4852.

What is Form 4852?

When you need to file your tax returns and, for whatever reason, you can’t get your W-2s or 1099s, what do you do? No, the answer is not “don’t pay taxes.” In this rare situation, you use IRS Form 4852 to declare an estimated income.

Quick look:

- Form 1040: The individual tax return. This is the form nearly everybody sends to the IRS on tax day.

- Form W-2: Prepared by your employer to declare how much they’ve paid you over the past year.

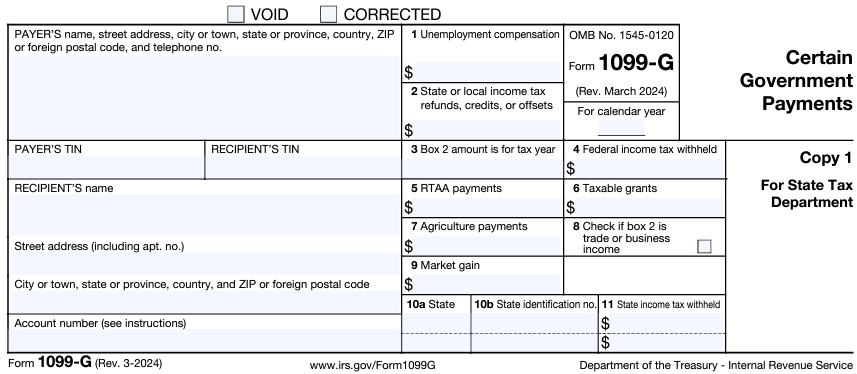

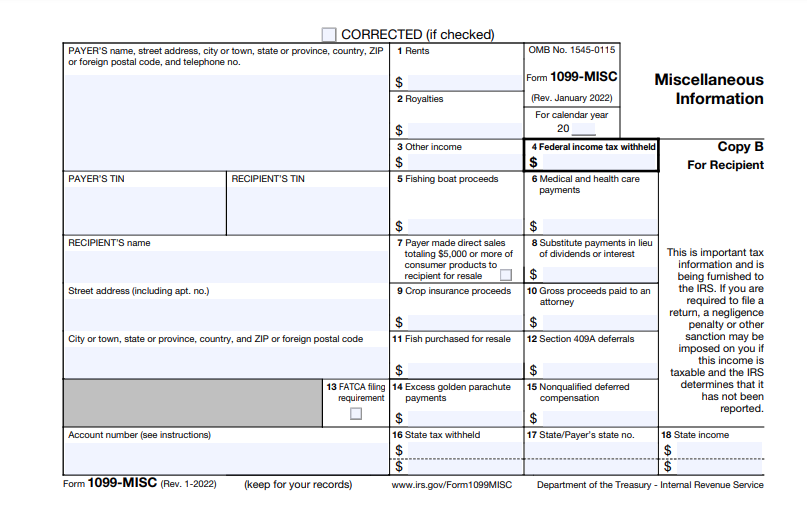

- Form 1099: Similar to a W-2, but it’s instead used to declare non-wage income.

- Form 4852: Our protagonist. Used to declare estimated income if you never received a W-2 or 1099.

| 📑Note: Unlike 1040s and 1099s, there’s only one type of Form 4852 to worry about. |

How do I file it?

Form 4852 is just attached to your regular tax return, but there’s a catch: you have to paper file your tax return if you use this form. That means going to the IRS website, downloading and printing the form yourself, and putting it in the mail. That doesn’t mean you can’t use an online tax tool, but you’ll have to print out what the program comes up with.

You must also attempt (with documentation) to obtain your W-2s and/or 1099s. Call your employer first, and then the IRS. The IRS takes this very seriously, and so should you.

How do I make a good estimate of what would have been on my W-2s/1099s?

In case you don’t know exactly what you made this year off the top of your head, several sources could work to get your estimated income.

- Your most recent pay stub’s year to date info

- Your income from last year

- Your annual salary

- Your online banking/payroll records

It’s not a math test, you just want to get as close as you can with what you’ve got.

What if my estimate is wrong

Don’t worry, you won’t get arrested if your estimate is off. Unfortunately, you will need more forms.

If you obtain your W-2 later or otherwise learn your estimate was wrong, your next step is to file an amended return with Form 1040-X to correct the amount. This is pretty much exactly like Form 1040, just with an extra page for you to explain what you’re correcting from your original tax return.

Do I need to file Form 4852?

Form 4852 can be useful but other options might be better, depending on the situation.

Should I file Form 4852 if I get a W-2 but I know it’s wrong?

Short answer: no.

If your employer gives you a W-2 that you know is incorrect, and you’re unable to get a correct W-2 in time, just go ahead and file your taxes with the W-2 you have. You won’t be penalized for using the information you were given, and you’re better off avoiding the fees and interest.

Later on, you can always file an amended tax return with Form 1040-X. No harm, no foul.

Should I file an extension instead of Form 4852?

There’s another option you can take when Tax Day approaches and you don’t have your W-2s: filing an extension. However, this may not be the ideal solution.

Extra time to file doesn’t mean extra time to pay, so filing an extension doesn’t prevent interest from piling up. Filing an extension also requires you to make an estimate of taxes due for the year, so if you’re making an estimate anyway, why not just file on time with Form 4852 and avoid interest altogether?

There are other reasons to file an extension, like if your deductions are especially complicated and your tax preparer needs more time to find maximum savings. If that’s you, make sure to file your extension by the due date for your original return.

If you’re definitely filing an extension, and you know you’re going to owe instead of getting a refund, it’s a good idea to pay an estimate of what you owe up front. Because interest accrues after the tax due date whether you get an extension or not, this way you minimize any extra tax liability.

There’s no need to be exact with the estimated payment. If you overpay, you’ll be refunded the difference. If you underpay, you only owe interest on the difference instead of the total tax payment.

Bottom line

Filing a tax return without your W-2s or 1099s might be annoying and inconvenient, but it’s still doable. Form 4852 is there to fill in the gaps so you can file your taxes without getting penalized.

And if you’re able to get ahold of your W-2s later, and it turns out your estimated income was off, no worries. You can file a correction later. But whatever you do – paper filing with Form 4852, filing an extension, or amending your return with a 1040-X later – make sure there’s a clear paper trail. The IRS loves paper trails.

Don’t want to spend all this time fixing mistakes? Schedule a call with DiMercurio Advisors and we’ll make sure all your ducks are in a row.