It's not a mountain in the Himalayas. It's an essential tax form for many business owners.

The IRS has just about a billion forms, and every single one of them is important. And if you’re an owner of a partnership or an S corp, you need to know about Schedule K-1. It’s like a W-2. Kind of.

Contents |

| How does a K-1 work? |

| K-1s for partnerships |

| K-1s for S corps |

| K-1s for trusts |

| When am I using K-1s? |

The basics

- Like a W-2 for certain types of non-wage income

- Generated during the tax prep process for relevant business types

- Attached to business tax returns to declare how a business entity’s income is split up and passed through to various partners

- Contains information necessary for business owners’ individual tax returns

- Typically used when tax liability is on individuals rather than the business entity itself (in other words, for a pass-through entity)

- Is also used for trusts and estates

- Provides detailed information so income, deductions, profit, losses, etc. can be accurately represented on the tax returns

How does a K-1 work?

Schedule K-1 is a federal tax form used to declare income (profits, losses, dividends) for a business, generally a partnership or an S corp. Less commonly, it can also be used to declare income going to beneficiaries of a trust.

The K-1 will contain information from the entity’s Form 1065 (for a partnership) or Form 1120-S (for an S corp). This can include the business entity’s Employee Identification Number (EIN), the individual partner, shareholder, or beneficiary’s personal information, their share of debts, their shares of various types of income, and more. The tax preparation process for these types of businesses will generally include the preparation of any necessary Schedule K-1s.

The K-1 generated is then used by the individual business owners to complete their individual tax returns.

Who uses K-1s?

Not everyone will need to use K-1s. In general, only the owners of pass-through entities and the beneficiaries of trusts or estates need to worry about these.

|

👩🏫Note: A pass-through entity is a business in which income is taxed |

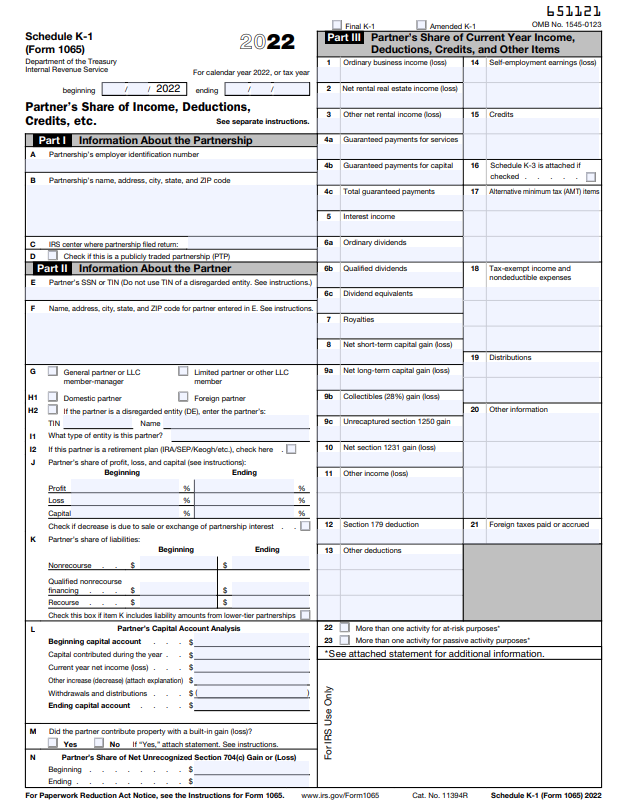

K-1s for partnerships

Partnerships (a type of business owned jointly by two or more partners) use a Schedule K-1 (1065 version) to declare how much of the income is going to each individual partner.

Each partner receives an individual K-1 that describes their own share of profits or losses. These K-1s are attached to the business’ Form 1065 tax return and, like a W-2, will be used to complete their individual tax returns on Form 1040.

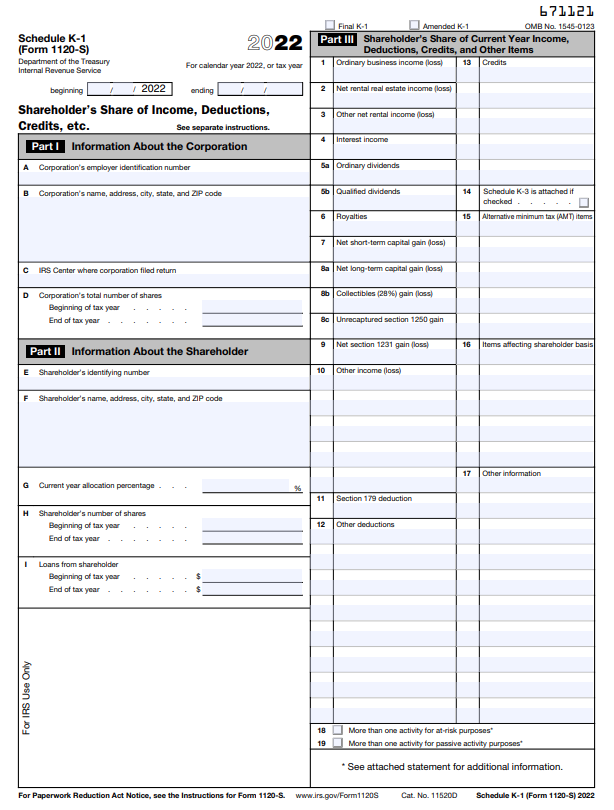

K-1s for S corps

S corps (a type of business entity owned by up to 100 shareholders) also use K-1s. Like with partnerships, an S corp will prepare a Schedule K-1 (1120S version) for each shareholder to complete their personal tax returns. In this case, the Schedule K-1s are generated from Form 1120-S, the S corp version of the business tax return.

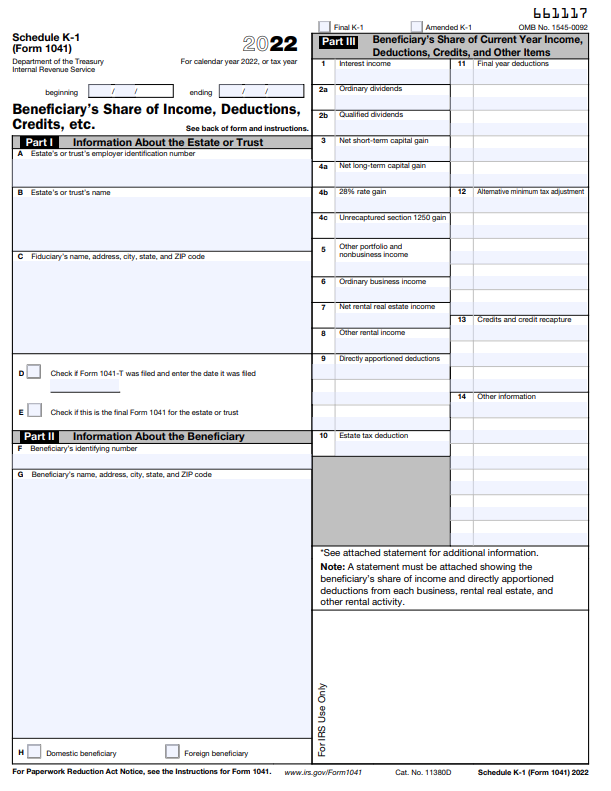

K-1s for trusts

Schedule K-1 (1041 version) is a lot less common than the K-1s for partnerships (1065) and S corps (1120-S), but it’s pretty similar. It’s used to declare the income that the beneficiary of a trust has received from that trust throughout the year, as well as any deductions or credits earned.

When am I using K-1s?

K-1s are due when the business or trust is required to file their income tax return (typically, that's March 15th for a partnership or S-Corporation and April 15th for trusts). The IRS will fine businesses that fail to issue K-1s by the deadline.

Normally, K-1s are generated as part of the process of preparing the business tax returns on Forms 1065 or 1120-S, so as long as your business stays on top of its taxes, that shouldn’t be a problem.

What if it’s late?

Sometimes tax preparation takes longer than expected. If your K-1 isn’t ready on time, you can file an extension to give yourself an extra 6 months to prepare your individual tax return.

However, please keep in mind that an extension just gives you extra time to file your taxes, not extra time to pay. Your tax bill is still due on Tax Day, and penalties and interest will begin to accrue. Even if you’re filing an extension, go ahead and pay what you think you owe. If it’s not totally accurate, the IRS will send you a bill or a refund and you’ll avoid any unnecessary penalties.

Bottom line

The K-1 is very similar to a W-2 or a 1099, just for different types of income. Like the W-2 or 1099, it’s essential for the individuals earning that income to prepare their tax returns. As long as you remember it’s like a W-2 for income earned through partial ownership of a partnership or an S corp, you should have the right idea.

Sounds pretty important, right? If you’re worried about getting your K-1s out with plenty of time to spare, or if you just want to make tax season easier than ever, schedule a call with the experts at DiMercurio Advisors. We can take care of the hard part.