Form 1099 is typically used to report the income of people who aren’t your employees, like contractors and freelancers. But there are more scenarios where you have to issue a 1099.

Just like you issue W-2s for your employees, you have to issue a similar form for your contractors and other non-employees called a Form 1099.

If you paid someone who wasn’t an employee $600 or more, you’ll likely have to issue them some type of 1099. There are several different kinds of 1099 forms — some of which are for very specific instances like interest payments on business debt and dividend payments to company shareholders.

With so many types of Form 1099s, it can be confusing to decide which ones to issue and when. Here are all the rules and recent changes you need to know as a small business owner before you issue a 1099.

Contents |

| What is a 1099? |

| When to issue 1099-NEC and 1099-MISC |

| When to issue Form 1099-INT |

| How to issue Form 1099 |

| 1099-related penalties |

What is a 1099?

A Form 1099 is what business owners send to non-employees annually to report how much the business paid them. The IRS calls them “information returns.” The purpose of 1099s is to help the IRS make sure people report their actual income and help non-employees accurately report their earnings.

The most common reason you might fill out a 1099 is if you work with an independent contractor. In that case, the type of form you’ll issue is a 1099-NEC, for non-employee compensation. The IRS says you must fill one out if you paid $600 or more to non-employees.

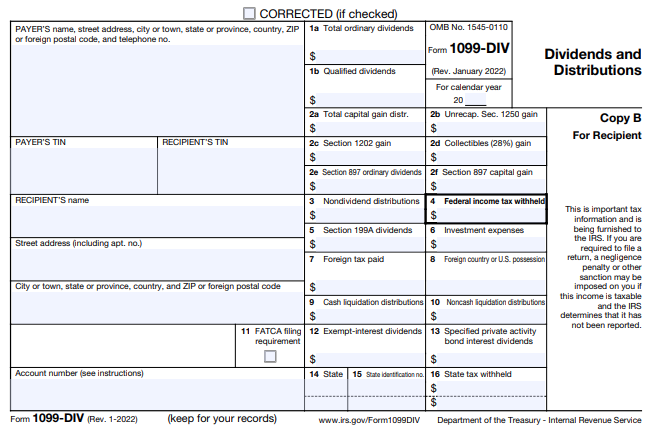

In some cases, you may have to issue someone multiple 1099s. For example, if you paid an individual shareholder interest for a loan, it would be reported on Form 1099-INT. If you also paid them dividends on their investment in the corporation, it would be reported on Form 1099-DIV.

You only have to complete it for business-related payments — not for personal expenses. You don’t need to issue a 1099 if you paid someone $600 for personal home repairs, for example.

When to issue 1099-NEC and 1099-MISC

Two of the three most common types of 1099s small business owners will issue are Forms 1099-NEC and 1099-MISC.

Here's when they're both due for the 2021 tax year:

- Form 1099-NEC: January 31(to recipients and the IRS)

- Form 1099-MISC: January 31 (to recipients)

- Form 1099-MISC: February 28 (to the IRS if you're e-filing)

- Form 1099-MISC: March 31 (to the IRS if you're paper filing)

Until the 2020 tax year, business owners issued Form 1099-MISC, for miscellaneous income, to their independent contractors. Now the IRS requires you to use a Form 1099-NEC for that purpose.

There are a couple of reasons for this change, according to Forbes. One reason was to remove the confusion of having two different deadlines for Form 1099-MISC: one for contractors, and one for everyone else. The second reason was to allow the Form 1099-NEC to have the same due date as the Form W-2.

When tax season rolls around, don’t get the two forms confused. Here’s an overview of when you should issue each of them.

1099-NEC

This form is specifically for independent contractors. The IRS lists these guidelines for determining if you should issue someone a 1099-NEC. You should issue one if you paid someone who’s not your employee $600 or more during the tax year for business purposes.

There are a few other things to keep in mind. You only need to issue a Form 1099-NEC for direct payments made by cash, check, electronic funds transfer, automated clearing house, wire, etc. Any payment made indirectly, through a credit card, for example, does not need to be reported on a 1099.

Another instance you wouldn’t have to report on a 1099 is a payment made to a C corp or S corp.

1099-MISC

If you’re not paying an independent contractor but have paid another non-employee $600 or more, you’ll likely need to issue them a 1099-MISC. Here are some types of payments that require you to issue one:

- Prizes

- Awards

- Medical and healthcare payments

There are other situations where you have to issue a 1099-MISC even if you didn’t pay $600 or more. These exceptions include:

- $10 or more in royalties or broker payments

- Any amount spent on an attorney

- Any amount withheld federal income tax

The IRS also lists “other income payments” as a catch-all in case your payment doesn’t fit one of the other 1099 forms.

When to issue Form 1099-INT

Form 1099-INT is used to keep track of interest income. So if you paid a non-employee at least $10 in interest, you’ll have to issue them a 1099-INT.

Specifically, you have to report what you paid people in boxes 1, 3, and 8 on the form. What do those mean?

- Box 1: interest income

- Box 3: interest on U.S. Savings and Treasury obligations

- Box 8: Tax-exempt interest

If you paid someone in interest that doesn’t fit one of those boxes, but it totaled $600 or more, you have to report that, too.

According to the IRS, there are some entities that don’t require a 1099-INT to be issued, including:

- Tax-exempt organizations

- Corporations

- Any Individual Retirement Accounts (IRA)

How to issue Form 1099

Knowing when and which 1099 forms to issue is the hard part. Now that you have all the right forms, here’s how to issue them step-by-step.

If you want more time to focus on the parts of your business that you love instead of issuing 1099s, you can schedule a free call with DiMercurio Advisors or use reputable sites like Track1099 to do it for you.

Step 1: Obtain a W-9

This should be done as soon as you decide to work with a contractor, and before you even begin to work with them. Their W-9 will give you their taxpayer identification number and other personal information, which you’ll need when issuing their 1099.

For forms like 1099-MISC or 1099-INT that aren’t issued to contractors specifically, you still need a W-9 to confirm the recipient’s Social Security number, mailing address and other information.

Step 2: Find out how much you paid

Check that you have the correct amount you paid the non-employee. You’ll need to put that amount on the 1099 — so keep your payments to them well-organized throughout the year.

Step 3: Send out Copy A and Copy B

You’ll need two copies of Form 1099: Copy A and Copy B.

You report the same information on both, but you’ll send Copy A to the IRS and Copy B to the non-employee.

Sending Copy A to the IRS is simple: You can either do it online or by mail. If you do it by mail, make sure to scan this version of Copy A and send it to them. The IRS warns you not to download a copy yourself and then scan it because you might face a penalty.

Sending Copy B to the contractor can be a little bit more complicated. If you want to send them the copy by email, you need their consent to do so. Specifically, the IRS says you can only send the non-employee their 1099 copy electronically if they:

- Give their written consent

- Don’t withdraw that consent before their receive it

- Consent electronically in a way that shows they can access the statement in the same format you provide it in

You can send them their copy by mail without getting their written consent.

1099-related penalties

It’s important to understand what forms you need to issue as soon as possible because if you’re late, you could be on the hook with fees. Depending on the form and how long the deadline has passed, the penalty ranges from $50 to $270 per form. If the IRS believes you showed intentional disregard for not filing correctly, the penalty could go up to $550 for each return or statement.

If you work with a large number of contractors, those penalties could add up fast. The timing of when you issue your 1099s can also make a big difference.

The bottom line

Issuing 1099s during tax season can be confusing or even stressful for business owners. If you don’t do it right, on time, or at all, it could cost you additional fees and penalties.

If you’re working with contractors regularly, you’re going to have 1099s to issue during tax season — and a lot of them. They’ll likely either be 1099-MISC or 1099-NEC forms, and now you know when to use each of them.

Need additional guidance or want more time on your hands to focus on the parts of your business you love? Schedule a free call with a DiMercurio Advisors team member today.