Understanding the purpose of a tax form or schedule is never a pleasant experience. That's why we created a comprehensive tax form library, showcasing the most frequently used tax forms and schedules you may encounter. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

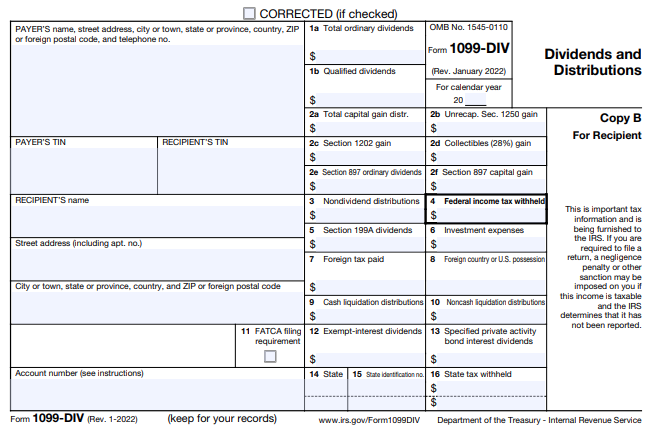

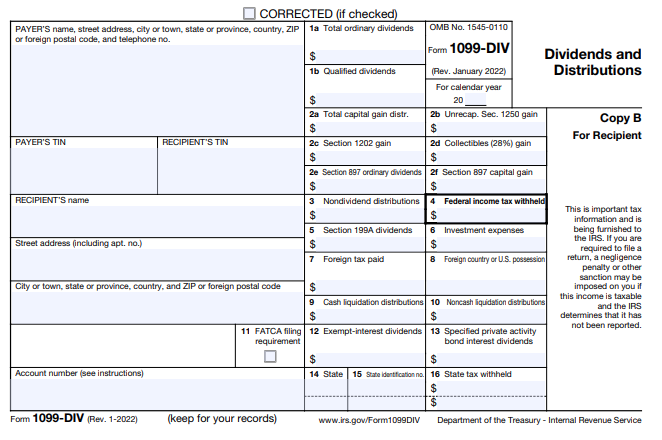

- What is the form number? Form 1099-DIV

- What government agency is it filed with? The Internal Revenue Service (IRS)

- What is the form name? Dividends and Distributions

- What is this form about? Form 1099-DIV is issued by corporations or financial institutions to shareholders who have received dividends during the year. It reports the total amount of dividends paid and any capital gains distributions.

What does it look like?

Resources

Looking for more information about this form? Here are some helpful resources:

- About the form - https://www.irs.gov/forms-pubs/about-form-1099-div

- Example copy of the form - https://www.irs.gov/pub/irs-pdf/f1099div.pdf

- Form instructions - https://www.irs.gov/pub/irs-pdf/i1099div.pdf

How can we help you today?

Looking for more information about this or other tax forms? The tax team at DiMercurio Advisors are tax compliance experts. We are passionate about ensuring you are well-informed and in control of your tax situation.