By now, you've probably heard about the Corporate Transparency Act. If you haven't, it's a law that impacts nearly every non-publicly traded company in America. It requires that businesses disclose information on 25% or more owners of the business or those who have control over the business, such as key decision-makers and senior officers.

This article will walk you through how to file your Beneficial Owner Information report. Business owners should educate themselves on the Corporate Transparency Act and make sure they know how to obtain an individual FinCEN ID too.

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) is a statute approved by Congress in 2019 as part of the Anti-Money Laundering Act, itself part of the National Defense Authorization Act (a bill passed every year to fund the military, which often contains legislation only loosely related to national security).

The CTA requires most businesses to disclose their “ultimate” owners: the investors behind the scenes. It’s intended to clamp down on, in Congress’ words, “bad actors” in the shadows who may be using businesses as fronts for money laundering, tax fraud, or even financing terrorism.

These disclosures are known as “Beneficial Ownership Information” or BOI reports, and the reporting mechanism is handled by FinCEN over at the Treasury Department.

Am I required to file one?

Not everyone is on the hook for filing a BOI Report. Generally speaking, if your business falls within certain categories, you may just be exempt from this part of the CTA. There are 23 exemptions; some of the notable ones are investment company or investment advisor (exemption 10), venture capital fund advisor (exemption 11), pooled investment vehicle (exemption 18), tax-exempt entity (exemption 19), large operating company (exemption 21), and inactive entity (exemption 23). The complete list can be found in the Small Business Compliance Guide.

Always keep an eye on the fine print, even if you're exempt. Regulations have a tendency to change, and you don't want to be caught off guard.

How do I file it?

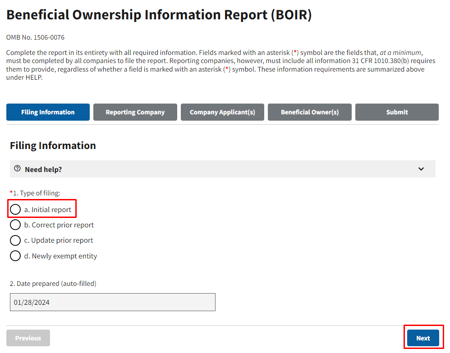

Here are the step-by-step instructions. Because of the rules' complexity, we've assumed that your business was started before January 1, 2024. If this is not the case, do not use these instructions to file your BOI report.

Step 1 - Go to the BOI filing website

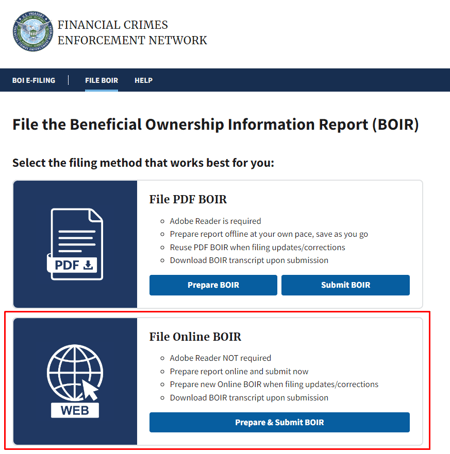

- Go to https://boiefiling.fincen.gov/fileboir

- Select "Prepare & Submit BOIR" under the web section.

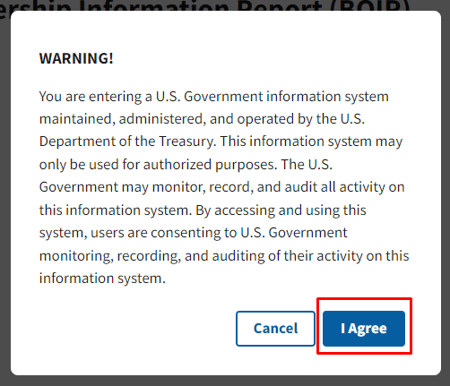

Step 2 - Agree with the statement

Read the statement on your screen and indicate if you agree.

Step 3 - Enter filing information

First, you'll indicate this is your initial filing.

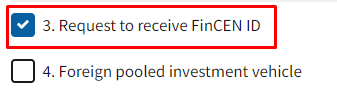

Next, you'll indicate that you would like to receive a FinCEN ID.

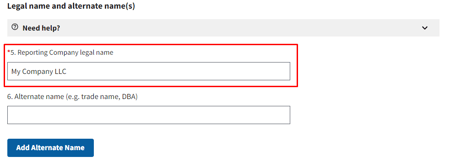

Step 4 - Enter information about the reporting company

First, enter your legal business name as it appears in your articles of incorporation or organization (it should match your name as shown by the state you formed the business in and should also match your books and records - they should all match). If you operate under any DBA, enter that as well (if you have more than one DBA, you can enter those by clicking the blue "Add Alternate Name" button).

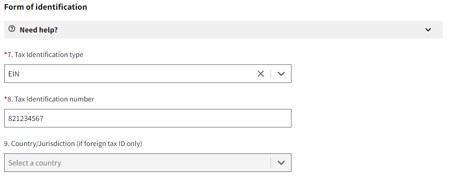

Second, enter your tax identification type. For nearly every business, you should select "EIN" and enter your employer identification number (typically shown on the top right-hand corner of your federal income tax return).

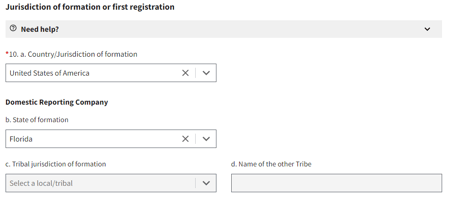

Third, enter information about where you formed your business. It's important to note that many businesses today operate in multiple states and often are registered to do business in those states. For this question, they are looking for the first state you registered to do business in.

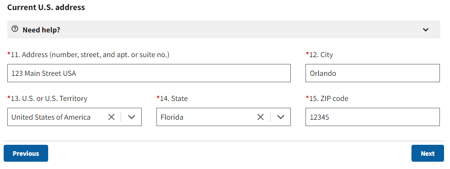

Fourth, enter your company mailing address. When you are done, click the blue "Next" button.

Step 5 - Enter company applicant information

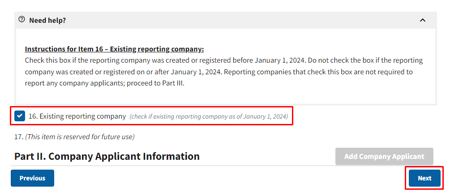

At first glance, this section might seem intimidating. However, you only have to do one thing on it (assuming you started your business prior to January 1, 2024), and that's select that you are an "Existing reporting company." Then click the blue "Next" button.

Step 6 - Enter beneficial owner information

A HUGE REMINDER here! Don't forget that beneficial owners include those who have substantial control over the business, even if they aren't direct or indirect owners of the business. This can cause some confusion, so make sure you understand who should be reported here. More details can be found in our article All About the Corporate Transparency Act.

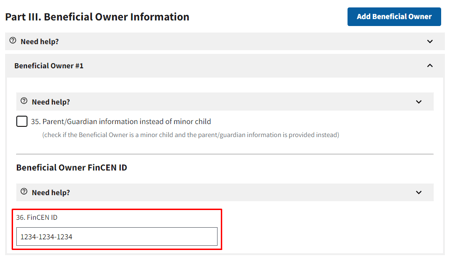

What to do next depends on whether you have a FinCEN ID for any beneficial owners. We highly recommend obtaining a FinCEN ID if a beneficial owner is affiliated with multiple businesses. The process is quick and simple (link to our guide on how to obtain one!)

For each beneficial owner after the first, you'll need to click the blue "Add Beneficial Owner" button on the top right. Once you are done entering beneficial owners, you can click Next on the bottom right.

If the beneficial owner has a FinCEN ID, enter that ID.

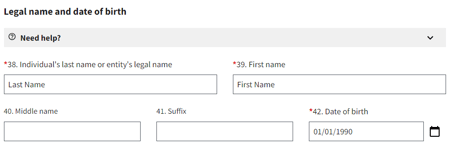

If the beneficial owner does not have a FinCEN ID...First, enter their legal name and date of birth.

Second, enter their address.

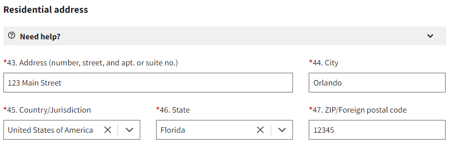

Third, enter their identity proof (typically with a driver's license or passport). Make sure to upload a copy of their documentation as well.

Step 7 - Submit the filing

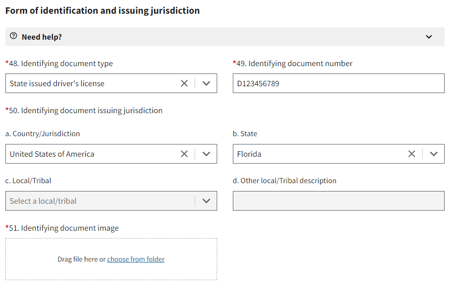

Now, the fun part. The person who completed the document will need to provide their information. If that person is not one of the beneficial owners, I'd highly recommend that they are certain they completed everything correctly and know what they were filing. This ensures there are no issues for that person later on.

Enter the requested information, indicate you agree to the certification statement by checking off the "I agree" statement, and then verify you are a human using the Captcha on the bottom.

After, you simply click the blue "Submit BOIR".

Once you are done, you'll be offered to download a copy of what you submitted. Please, oh, please do this! Click the blue "Download Transcript" button and then store that document with your other important papers. It's extremely important as this PDF will contain your business FinCEN ID as well - you'll need that for filing updates to the report in the future.

Can someone else help me do this?

We get it. This could be overwhelming and complicated for you. In fact, we suspect that most businesses will ask someone for help. And that's okay! However, we highly recommend that you work with those who have experience in understanding the reporting requirements to ensure that they are being taken care of properly.

Most attorneys providing business formation and general counsel services should be able to help you. Experienced CPAs can also be a wealth of assistance, especially those that provide business formation services and/or provide strategic advice to their clients.

Ultimately, you are responsible for this filing, so make sure you pick the right partner to help you through it.

The bottom line

Staying compliant is complicated, but it doesn't have to be. This step-by-step guide walks you through how to file your initial BOI report. However, if you want extra reliance on knowing it was filed correctly, we highly recommend you work with an experienced attorney or CPA who can help you navigate the rules.

Our team of experts will be more than happy to help you navigate the CTA reporting requirements and other business needs like tax compliance and bookkeeping. Schedule a call and let us know how we can make your life easier.