Nearly all businesses in America are affected, so now’s a good time to learn all about the CTA.

The basics

- The Corporate Transparency Act is a big-time reporting requirement for most businesses in America

- It’s intended to catch financial crimes by mandating all business ownership be disclosed to the federal government

- There are some pretty steep penalties for not reporting your ownership

- It’s a new law, and the government hasn’t fully explained how it’s all going to work yet, so stay tuned

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) is a statute approved by Congress in 2019 as part of the Anti-Money Laundering Act, itself part of the National Defense Authorization Act (a bill passed every year to fund the military, which often contains legislation only loosely related to national security).

The CTA requires most businesses to disclose their “ultimate” owners: the investors behind the scenes. It also requires disclosure of those who exercise substantial control over the business. It’s intended to clamp down on, in Congress’ words, “bad actors” in the shadows who may be using businesses as fronts for money laundering, tax fraud, or even financing terrorism.

These disclosures are known as “Beneficial Ownership Information” or BOI reports, and the reporting mechanism is handled by FinCEN over at the Treasury Department.

What is FinCEN?

FinCEN is short for the Financial Crimes Enforcement Network, a part of the Treasury Department. This government bureau was created in 1990 to analyze information reported under the Bank Secrecy Act and has since then worked in combination with other law enforcement bureaus to combat money laundering and other financial crimes.

Is this required?

There is no way around it: Every corporation, LLC, or other entity created by filing with a Secretary of State (or the equivalent) must file a BOI report. These entities will often be referred to as “reporting companies” in discussions about the CTA.

There's always an exception, right? This is no different. There are 23 categories of exemptions, mostly for entities that already have to report the information demanded by the CTA anyway.

What is a beneficial owner?

This one might be a little confusing. A beneficial owner has two descriptions to apply:

- An individual who owns, directly or indirectly (that indirectly part is important), 25% or more of a company's ownership interests; or

- An individual who exercises substantial control over the business (think senior-level leaders)

What are ownership interests?

We might think of stock or LLC units as an ownership interest; however, for purposes of the CTA, there's a broader description of what is considered an ownership interest.

Here's how FinCEN describes it.

- Equity, stock, or voting rights - any interest classified as stock or anything similar, regardless of whether it confers voting power or voting rights, and even if the interest is transferable. Examples include:

- Equity, stock, or similar instrument

- Preorganization certificate or subscription

- Transferable share of, or voting trust certificate or certificate of deposit for, an equity security, interest in a joint venture, or certificate of interest in a business trust

- Capital or profit interest - Any interest in the assets or profits of a company organized as an LLC, which is similar to stock in a corporation and sometimes referred to as a "unit".

- Convertible instruments - any instrument convertible into equity, stock or voting rights, or capital or profit interest, whether or not anything needs to be paid to exercise the conversion. The related items are also ownership interests:

- Any future on any convertible instrument

- Any warrant or right to purchase, sell, or subscribe to a share or interest in equity, stock, or voting rights, or capital or profit interest, even if such warrant or right is a debt

- Option or privilege - Any put, call, straddle, or other option or privilege of buying or selling equity, stock, voting rights, or capital or profit interest, or convertible instruments, EXCEPT if the option or privilege is created and held by others without the knowledge or involvement of the reporting company.

- Catch all - any other instrument, contract, arrangement, understanding, relationship, or mechanism used to establish ownership.

What is substantial control?

While this might seem "super easy" too, it's really not. FinCEN wants to know about the individuals working for the business that can exercise certain types of control over the business.

You might think it's just officers of the business that have substantial control; however, it could be anyone. While you would be correct, other officers (or just other individuals) could exercise substantial control without being an officer. We're thinking about it by asking this question: "Name every person that, if they called, you would be compelled to do what they said." Whoever those people are should be listed as exercising substantial control.

Here's how FinCEN describes it.

- Senior officer - Any individual holding the position or exercising the authority of a:

- President

- Chief Financial Officer (CFO)

- General Counsel (GC)

- Chief Executive Officer (CEO)

- Chief Operating Officer (COO)

- or any other officer, regardless of official title, who performs a similar function to the officers listed above.

- Appointment or removal authority - Any individual with the ability to appoint or remove any senior officer or a majority of the board of directors or similar body.

- Important decision maker - any individual who directs, determines, or has substantial influence over important decisions made by the reporting company, including decisions regarding the report company's:

- Business, such as:

- Nature, scope and attributes of the business

- The selection or termination of business lines or ventures, or geographic focus

- The entry into or termination, or the fulfillment or non-fulfillment, of significant contracts

- Finances, such as:

- Sale, lease, mortgage, or other transfer of any principal assets

- Major expenditures or investments, issuances of any equity, incurrence of any significant debt, or approval of the operating budget

- Compensation schemes and incentive programs for senior officers

- Structure, such as:

- Reorganization, dissolution, or merger

- Amendments of any substantial governance documents of the reporting company, including the articles of incorporation or similar formation documents, bylaws, and significant policies or procedures

- Business, such as:

- Catch all - Any other form of substantial control over the reporting company. Control exercised in new and unique ways can still be substantial. For example, flexible corporate structures may have different indicators of control than the indicators included here.

Whose names are listed?

Oh, that's a good one. And this is where things get interesting as it's another "it depends" type of situation. Ultimately, they want the name of an individual - no hiding behind other LLCs, corporations, or even foreign corporations. Nope, they want to know the wonderful humans that have ownership or exercise control. Period.

We need to discuss a few things before diving into the examples:

- Sometimes, a business might have other businesses as owners. That doesn't fly here - you'll need to make inquiries to understand both their ownership structure and who can exercise substantial control over them, too. At a minimum, you should be reporting at least one individual.

- If a trust is involved, you'll look at who has substantial control over the trust and report those individuals. You might want to speak with an attorney here, as trusts can be very complicated.

Examples [with pictures]

It’s been a little abstract so far, so here are four examples to help you understand how this works. Each one gets a little more complex, so make sure to follow along from the beginning!

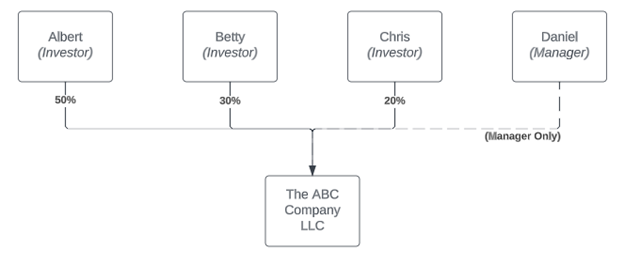

Example 1

First up, The ABC Company LLC. The business is owned by three individuals and managed by a fourth individual who holds no ownership interest.

Who should be included on the BOI report?

- Albert must be reported because he directly owns 50%.

- Betty must be reported because she directly owns 30%.

- Chris does not need to be reported because he directly owns 20%.

- Daniel must be reported because he has substantial control over the business (as manager).

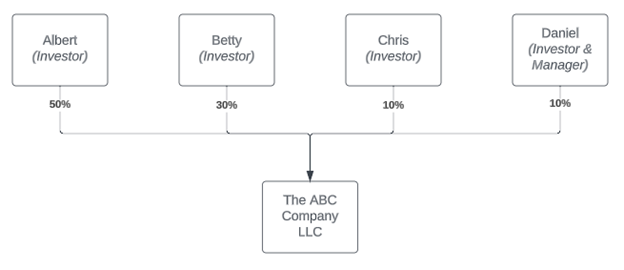

Example 2

Next, we’re looking at The ABC Company LLC (totally different company from Example 1, by the way). The business is owned by four individuals, with one of the owners also serving as the manager.

Who should be included on the BOI report?

- Albert must be reported because he directly owns 50%.

- Betty must be reported because she directly owns 30%.

- Chris does not need to be reported because he directly owns 10%.

- Daniel must be reported because he has substantial control over the business (as manager), but not because he directly owns 10%.

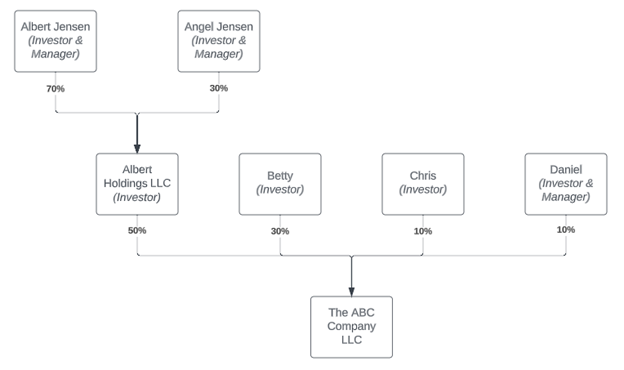

Example 3

Now let’s check out The ABC Company LLC (no relation). The business is owned by one LLC and three individuals, with one of the individuals serving as the manager.

Who should be included on the BOI report?

- Albert Jensen must be reported because he indirectly owns 35% (50% x 70%) and because he can exercise substantial control over Albert Holdings LLC (a 50% owner of The ABC Company LLC) as a manager.

- Angel Jensen must be reported because she can exercise substantial control over Albert Holdings LLC (a 50% owner of The ABC Company LLC) as a manager, but not because of her indirect ownership, which is only 15% (50% x 30%).

- Betty must be reported because she directly owns 30%.

- Chris does not need to be reported because he directly owns 10%.

- Daniel must be reported because he has substantial control over the business (as manager), but not because he directly owns 10%.

In addition, Albert Holdings LLC has its own filing requirement, and it must file a BOI Report showing both Albert Jensen as a direct owner of 70% and Angel Jensen as a direct owner of 30% (and because they both can exercise substantial control over Albert Holdings LLC)

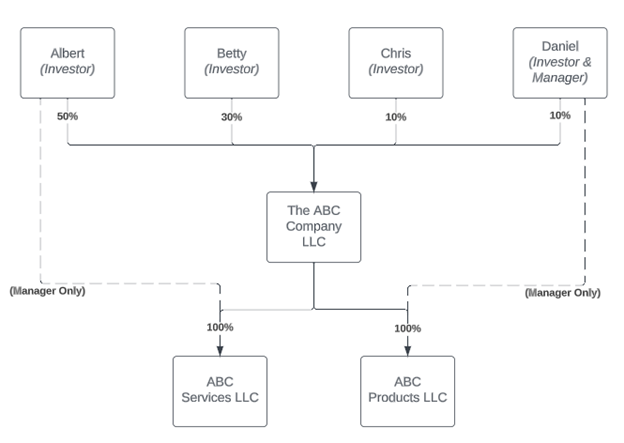

Example 4

Here’s a more complex one in case you need an example of how the reporting requirements work with holding companies. Here, we have three LLCs – The ABC Company LLC, ABC Services LLC, and ABC Products LLC – with two managers and four owners. Let’s crack it open.

Who should be included on the BOI reports?

For The ABC Company LLC:

- Albert must be reported because he directly owns 50%.

- Betty must be reported because she directly owns 30%.

- Chris does not need to be reported because he directly owns 10%.

- Daniel must be reported because he has substantial control over the business (as manager), but not because he directly owns 10%.

For ABC Services LLC:

- Albert must be reported both because he has substantial control over the business (as manager) and because he indirectly owns 50% (50% x 100%) .

- Betty must be reported because she indirectly owns 30% (30% x 100%).

- Chris does not need to be reported because indirectly owns 10% (10% x 10%).

- Daniel must be reported because he has substantial control over the business (as manager of The ABC Company LLC), but not because he indirectly owns 10% (10% x 10%).

For ABC Products LLC:

- Albert must be reported because he indirectly owns 50% (50% x 100%).

- Betty must be reported because she indirectly owns 30% (30% x 100%).

- Chris does not need to be reported because he indirectly owns 10% (10% x 100%).

- Daniel must be reported because he has substantial control over the business (as manager), but not because of he indirectly owns 10% (10% x 100%).

If this one made your head hurt, you aren’t alone. But this ownership structure is actually pretty common!

If your business is a multi-entity structure like this, we highly recommend you map everything out on a flow chart. Your business structure can be much easier to understand when you can see it all laid out in front of you. Ask your CPA – there’s a good chance they’ve already made a flowchart for your business.

Who is exempt from filing?

There are 23 categories of exemptions, mostly for entities that already have to report the information demanded by the CTA anyway. Let's go through the most common ones on the list (if you're looking for the full list with details, you can see those listed in the Small Entity Compliance Guide).

Investment company or investment advisor (exemption 10)

In order to qualify for the investment company or investment advisor exemption, you must be able to say yes to all of these statements:

- The entity is an “investment company” or “investment adviser” defined as either:

- An investment company in section 3 of the Investment Company Act of 1940 (15 U.S.C. 80a-3); or

- An investment adviser in section 202 of the Investment Advisers Act of 1940 (15 U.S.C. 80b-2).

- The entity is registered with the Securities and Exchange Commission under either of these authorities:

- The Investment Company Act of 1940 (15 U.S.C. 80a-1 et seq.); or

- The Investment Advisers Act of 1940 (15 U.S.C. 80b-1 et seq.).

Venture capital fund advisor (exemption 11)

In order to qualify for the venture capital fund advisor exemption, you must be able to say yes to all of these statements:

- The entity is an investment adviser that is described in section 203(l) of the Investment Advisers Act of 1940 (15 U.S.C. 80b-3(l)).

- The entity has filed Item 10, Schedule A, and Schedule B of Part 1A of Form ADV, or any successor thereto, with the Securities and Exchange Commission.

Pooled investment vehicle (exemption 18)

In order to qualify for the pooled investment vehicle exemption, you must be able to say yes to all of these statements:

- The entity is a pooled investment vehicle if either of these statements apply to the entity:

- Is an investment company, as defined in section 3(a) of the Investment Company Act of 1940 (15 U.S.C. 80a-3(a); or

- Is a company that would be an investment company under that section but for the exclusion provided from that definition by paragraph (1) or (7) of section 3(c) of that Act (15 U.S.C. 80a-3(c)); and is identified by its legal name by the applicable investment adviser in its Form ADV, (or successor form) filed with the Securities and Exchange Commission or will be so identified in the next annual updating amendment to Form ADV required to be filed by the applicable investment adviser pursuant to rule 204-1 under the Investment Advisers Act of 1940 (17 CFR 275.204-1).

- The entity is operated or advised by any of these types of exempt entities:

- Bank, as defined in Exemption #3;

- Credit union, as defined in Exemption #4;

- Broker or dealer in securities, as defined in Exemption #7;

- Investment company or investment adviser, as defined in Exemption #10; or

- Venture capital fund adviser, as defined in Exemption #11.

Tax-exempt entity (exemption 19)

In order to qualify for the tax-exempt entity exemption, you must be able to say yes to any of these statements:

- The entity is an organization that is described in section 501(c) of the Internal Revenue Code of 1986 (Code).

- The entity is an organization that is described in section 501(c) of the Code, and was exempt from tax under section 501(a) of the Code, but lost its tax-exempt status less than 180 days ago.

- The entity is a political organization, as defined in section 527(e)(1) of the Code, that is exempt from tax under section 527(a) of the Code.

- The entity is a trust described in paragraph (1) or (2) of section 4947(a) of the Code.

Large operating company (exemption 21)

In order to qualify for the large operating company exemption, you must be able to say yes to all of these statements:

- The entity employs more than 20 full-time employees, averaging at least 30 hours of service per week.

- More than 20 full-time employees of the entity are employed in the United States.

- The entity has an operating presence at a physical office within the United States.

- The entity entity filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales.

- The entity reported this greater-than-$5,000,000 amount as gross receipts or sales (net of returns and allowances) on the entity’s IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form.

- When gross receipts or sales from sources outside the United States, as determined under Federal income tax principle, are excluded from the entity’s amount of gross receipts or sales, the amount remains greater than $5,000,000.

Inactive entity (exemption 23)

In order to qualify for the inactive entity exemption, you must be able to say yes to all of these statements:

- The entity was in existence on or before January 2, 2020.

- The entity is not engaged in active business.

- The entity is not owned by a foreign person, whether directly or indirectly, wholly or partially. “Foreign person” means a person who is not a United States person.

- The entity has not experienced any change in ownership in the preceding twelve-month period.

- The entity has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month period.

- The entity does not otherwise hold any kind or type of assets, whether in the United States or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

When do I file?

Be careful here... there's a lot of uncertainty out there. As of this update (January 23, 2025) you are required to file a report. However, the dates and penalties mentioned below might change - we're waiting for FinCEN to tell us what they plan on doing. We'll provide additional details as they come available.

The initial report

As expected with an update to federal regulations, currently existing businesses will have a little more time to get their ducks in a row than newly created businesses will once the law is fully implemented.

- If your business was registered prior to 2024, then you have until January 13, 2025 to file your BOI report.

- If your business was registered on or after September 4, 2024 AND you had a filing deadline of December 3 through December 23, 2024, then you have until January 13, 2025 to file your BOI report.

- If your business was registered on or after December 3 and on or before December 23, 2024 then you have 111 days from the date you were registered (90 days for the original deadline plus an extension of 21 days) to file your BOI report.

- If your business will be registered on or after December 24, 2024 and on or before December 31, 2024, then you will have 90 days from the date you were registered to file your BOI report.

- If your business will be registered on or after January 1, 2025, then you will have 30 days from the date you were registered to file your BOI report.

However, just because existing businesses have some extra time to file doesn’t mean there’s no sense of urgency. The CTA is a big deal, with a lot of moving parts, and there may be unexpected setbacks when filing. We recommend you get it done early so you’re not caught between a rock and a hard place later – your CPA or attorney can help you get started.

Ongoing reporting

Once your initial report is completed, you’ll need to take care of ongoing reporting. Luckily, there are no annual reporting requirements. You simply need to file an updated BOI report within 30 days of any changes to the last report you filed.

This means that you'll need to put steps in place when your senior leadership (or those who can exercise substantial control over your business) changes, as well as when there is a direct or indirect change in the ownership of the business.

This can present a challenge when your owners might be other businesses or some other kind of entity with confidential ownership. What do you do then?

At the very minimum, we recommend that the legal documents governing how your business operates include language requiring all investors/owners to report any changes. While it’s not a perfect defense, if something goes wrong, it will allow you to show FinCEN you have actively been trying to comply with the law.

For larger investment vehicles like hedge funds, real estate funds, real estate syndications, and so on, we’re expecting to see them require their investors/owners to provide annual certifications if there are no changes to indirect ownership information.

This is a new law, so you’ll probably be hearing more from FinCEN over the years as they refine the process.

What information do I need to file?

As mentioned above, you’ll be required to file Beneficial Owner Information or BOI reports with FinCEN detailing everyone who owns or controls the entity.

Let’s walk through the specific information that FinCEN is looking for.

What information about the business has to be filed?

- Full legal name

- All trade names or DBAs (“doing business as,” a type of semi-official nickname)

- Current street address of the principal business location

- Jurisdiction of formation

- Taxpayer ID number

What information about the beneficial owners has to be filed?

- Full legal name

- Date of birth

- Current residential street address

- Picture of one of the following up-do-date documents: US passport, state or local ID, driver’s license, or a foreign passport (only if the individual doesn’t have any of the other options)

A lot of investors aren’t going to be happy about providing this information – it leaves them at risk of identity theft, and cybersecurity is still a developing field – but there are ways of managing their privacy, like a FinCEN identification number. We have more on privacy later in the article.

How do I file?

While the filing process itself is fairly straightforward, understanding the nuances of the law are not. The report can be filed directly on the FinCEN website.

Most businesses and individuals that currently have FinCEN reporting requirements use a CPA or law firm to file these types of reports, so a CPA or law firm will probably be able to help you navigate this new system too.

What does it cost to file?

There is no charge to file the BOI Report with FinCEN directly. However, if you use a CPA or attorney to file the report, you’ll have to pay their fee.

Depending on how complex your ownership structure is and how clean the ownership information you provide them with is, we anticipate CPA firms will charge somewhere between $250 and $750 per filing, and then their hourly rates for any advice, consulting, or assistance outside of the report filing (helping you gather documents, put things together, clarifying any questions you have, etc).

Law firms will probably charge their usual hourly rates, somewhere in the neighborhood of $250-$1000 per hour.

Why have someone else file it?

You’d want to have an expert, like your CPA or attorney, file these reports for you for several reasons.

- They already have an understanding of your structure so they can easily advise you on the reporting requirements.

- This is their job! If you’re working with a CPA – and you should be – this kind of thing is exactly what they were hired for. Let the accountant take care of it. Or at minimum, your attorney!

- These reports can be complicated. While the rules have bene clarified, they haven't been tested yet, and there could be major consequences if this doesn't get done correctly. Working with an expert is key to mitigating your risk.

If you work with a CPA already, great, this is what they do. And if you don’t work with a CPA, now is a great time to find one.

What happens if there’s a problem?

On the one hand, this is a totally new requirement, and a few mistakes are possible.

On the other hand, FinCEN is extremely serious about needing these reports, and there are some steep penalties if you fail to correct your mistakes for long enough.

This can get complex and scary very fast, and we still don’t know how it will be enforced.

What we do know: make sure you get it reported. Make sure you keep it updated. Mistakes are one thing, but negligence is a whole different ball game.

What are the possible penalties?

If you make a mistake, just correct it within 30 days.

If 30 days pass, and you still haven’t bothered to amend your incorrect report, you’ll start incurring a $500 per day penalty.

If you’re violating the CTA and falsifying or withholding information on purpose, it becomes a much more serious problem. That’s, like, an actual crime. You may face criminal penalties including a fine of up to $250,000, up to five years imprisonment, or both.

The key is to file the report, and if you catch an error, fix it right away. We recommend that, if you made the error yourself, you find an expert – like your CPA or attorney – who can help you navigate the requirements more successfully.

What if something changes in the information we’re reporting?

If there are changes in the beneficial owners or exemption status, file an update within 30 days. And that’s calendar days, not business days – you have a month. Still, shouldn’t be too complicated if you’ve already managed to get the original report filed.

Do I get to retain any privacy at all here?

This whole Corporate Transparency Act thing is designed to shine a light on business ownership, but privacy is still important.

As far as the federal government is concerned, you need to tell them everything (remember that $250,000 criminal penalty we mentioned above?). Complete the reports thoroughly and accurately.

However, not everyone needs to know what you’re telling Uncle Sam. You can apply to FinCEN directly for a unique “FinCEN ID” code which can then be provided to reporting companies for use on their BOI reports. That way, FinCEN knows who all the beneficial owners are, but their privacy is retained as much as possible from the businesses they're associated with.

Can anyone access these reports after the fact?

FinCEN is authorized to disclose owner information to a small list, such as federal agencies handling national security or intelligence, state law enforcement (with a court order), certain types of government regulators, etc. The authorities, basically.

But you don’t have to worry about that information being released to the public.

The bottom line

The Corporate Transparency Act is a big change, but as long as you get the reports filed properly (and on time!) you’ll be fine. Unless you are a foreign power laundering money to finance terrorism, you’re not the fish that FinCEN is looking to fry. Just complete the reports as best you can, work with a qualified professional, and follow any directions issued by FinCEN.

Speaking of qualified professionals, have you heard of DiMercurio Advisors? Our team of experts will be more than happy to help you navigate the CTA reporting requirements, as well as other business needs like tax compliance and bookkeeping. Schedule a call and let us know how we can make your life easier.