They’re not my lawyer, I don’t get it.

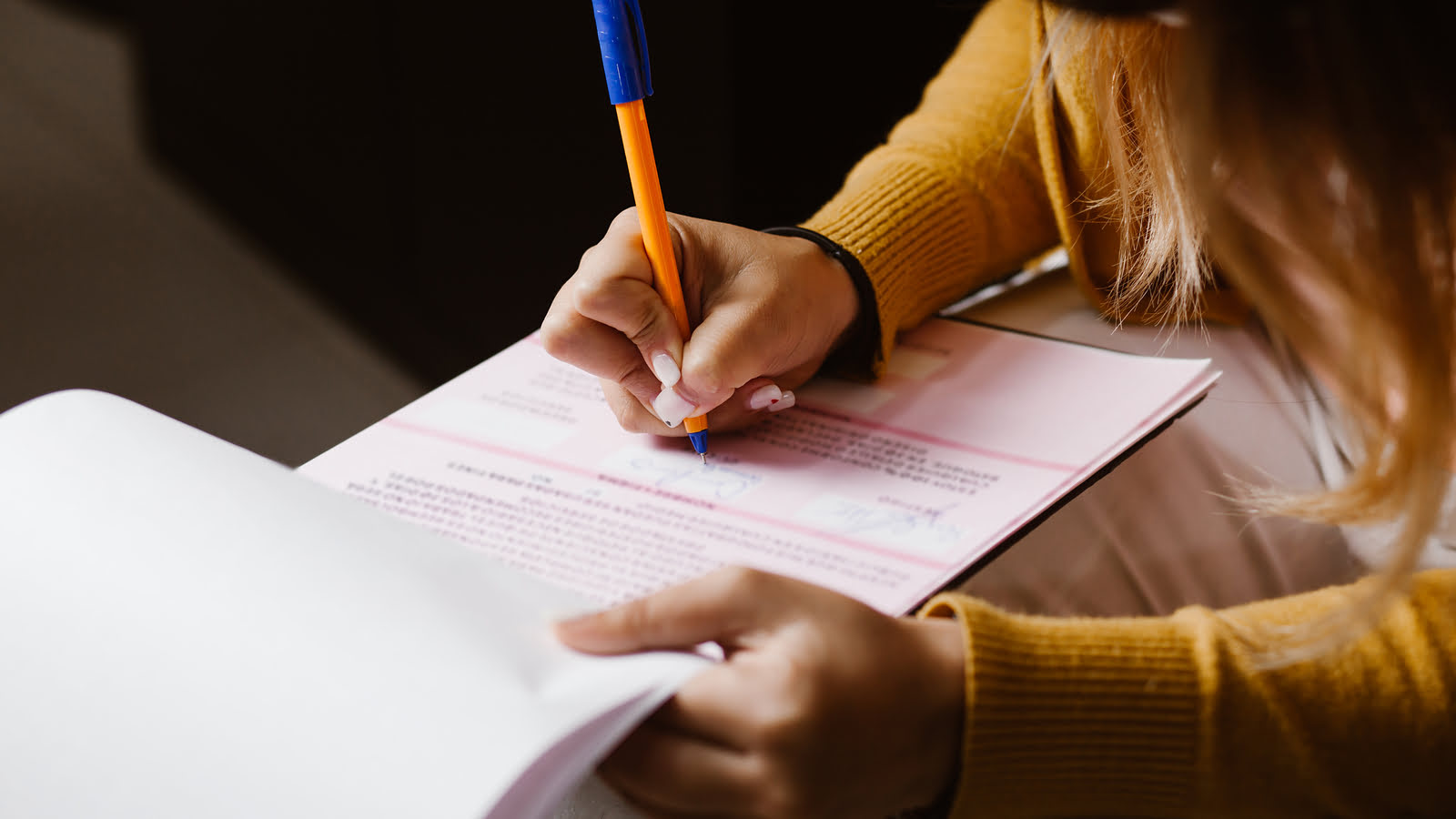

So, your accountant says to you "We'll need a power of attorney to resolve that for you." What the heck does that mean? A power of attorney sounds very intense, like something from a legal drama. But it’s a fairly routine legal document many people will need to utilize. One of those people may be your accountant.

The basics

- If you want your accountant to speak to the IRS or a state department of revenue on your behalf, they'll need your permission to do so.

- That permission is granted through a power of attorney.

- There is a cost to have a power of attorney filed by your accountant.

- You can revoke a power of attorney whenever you want.

What is a power of attorney?

In its simplest form, a power of attorney, referred to as a POA for short, is a legal document that allows you to appoint a person to manage certain affairs if you're unable to do so. Think of it as a legal "stand-in" or "proxy." It's like saying, "Hey, I trust this person enough to make decisions on my behalf." It doesn't sound so scary now, does it? It's not about giving up control but ensuring your affairs are in trusted hands when you need assistance.

There are many different kinds of POAs. Some types of POAs your accountant might need and others they won't ever need. For the purpose of this article, we're only going to focus on POAs your accountant will need. However, know that there are many types of them and they're part of legal documents everyone should have.

By the way, your accountant won't be asking you for a run-of-the-mill POA. Nope, they know better and so does the government. Instead, they'll ask you to complete a specific form authorized by the IRS or a state department of revenue. This includes listing out what tax years, tax forms, and so on, that the accountant is authorized to work on. This restricts the POA to only being for the matters that you authorize.

Why does my accountant need a power of attorney?

The thought of granting someone a POA might initially give you the jitters, but your accountant isn't trying to usurp you. They're looking to better serve you better with tasks such as:

- Communicating with the IRS: With a POA, an accountant can directly communicate with the IRS on the taxpayer's behalf (usually on the phone), making it very useful if there are any complications or disputes about the tax return.

- Handling audits: If the taxpayer's return is audited, having a POA allows the accountant to represent and defend them during the audit process, saving the taxpayer from potential stress and confusion.

- Resolving tax debts: If a taxpayer owes the IRS money, an accountant with a POA can negotiate payment plans or settlements.

Do I need a power of attorney for every tax authority?

Just like your favorite ice cream shop has lots of flavors, each with its own unique recipe, every tax authority, including the IRS and individual states, has their own version of a POA form. Why, you ask? Well, because every tax authority has its own set of rules, regulations, and ways of doing things. I promise it drives us crazy too!

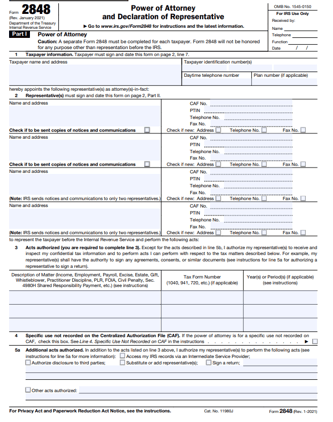

For instance, the IRS has Form 2848, Power of Attorney and Declaration of Representative. Pretty official sounding, isn't it? Here's what it looks like:

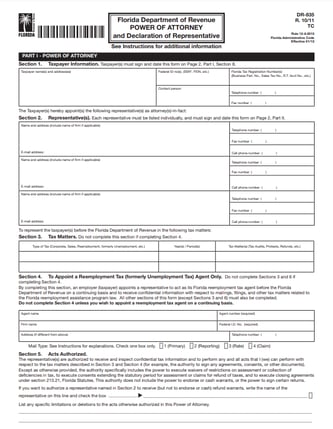

On the other hand, each state has their own version of a POA form that aligns with their specific state laws and tax codes. For example, Florida uses Form DR-835. Here's what that looks like:

And every other state has their own version, too. It's not as confusing as it sounds! Your accountant will guide you to the right form needed for your situation. So, no need to panic - you're in good hands!

By the way, this isn't a free pass for your accountant to make any and all decisions—they can only do what's specifically authorized in the POA document. This is why the form requires you to list your specific tax matters and the years or periods for which the POA is granted. So, it's a very focused POA, narrowly granting authority where needed and not a moment or dollar more.

Who gets permission to act on your behalf?

Great question! For the IRS and most states, only a select few can be authorized to represent you. These include:

- Certified Public Accountants (CPAs): Professionals who have passed the Uniform CPA Examination and met specific education and experience requirements can represent you.

- Enrolled Agents (EAs): These are federally licensed tax practitioners who have demonstrated technical competence in tax law and can represent taxpayers before all administrative levels of the IRS.

- Attorneys: A licensed attorney who is in good standing with their state bar association can serve as your representative.

As you can see, these are people who have passed tests, had background checks done on them, and proven they are able to effectively represent you in front of the IRS and any state department of revenue.

Something important to note is that if you are working with an accounting or tax preparation firm and asked to sign a POA, you could see a few team members listed. For example, at our firm, we'll list at least two individuals on every POA. This ensures that someone can always pick up the phone to handle a matter.

Does this mean my accountant gets a copy of everything?

When an accountant is listed on a POA they usually receive copies of most, but not all, tax notices and audit requests issued by the IRS and state tax authorities – assuming the correct checkbox on the form is marked.

It's important to note that the IRS and state taxing authorities do not share everything with your representative. There are some items, such as certain types of bills or notice of legal action, that are delivered only to the taxpayer directly. So, don't assume when your accountant has a POA that they're seeing everything.

Make sure you know what your accountant will do when they receive copies of notices from you. We typically see two approaches here:

- Ask first: With the ask first approach, the accountant will send you a copy of the notice they received and ask you if you want them to handle the notice for you. This is your opportunity to ask any questions about costs associated with them handling the matter for you.

- Handle it: With the handle it approach, the accountant will just respond to the notice on your behalf and invoice you for their work. This doesn't give you the opportunity to decide if you want to take a stab at it first.

Most methods have their pros and cons, however we've learned that the ask first approach is usually the best with business owners.

Can I cancel a power of attorney?

Absolutely, you can cancel this authorization! If at any point you decide you no longer need or want the assigned individual(s) to act on your behalf, you have the power to revoke the POA. This is usually called revoking your POA, and here's how you'd do it:

- IRS POA: To revoke an IRS POA, you'll need to write "REVOKE" across the top of Form 2848, sign and date it. Then, send the revocation to the IRS. See the instructions for Form 2848 to make sure you do this correctly.

- State POA: Each state has its own rules, so be sure to review the instructions for the state POA form to understand how to revoke it.

When in doubt, call the IRS or the state department of revenue. They'll be able to help you out.

What does it cost to prepare a power of attorney?

While filing a POA with the IRS or a state tax authority doesn't cost anything, having an accountant prepare it isn't free. These professionals bring their expertise, knowledge, and time to the table, ensuring that your POA is correctly prepared and that your best interests are efficiently represented.

This service generally costs $150+ per POA that needs to be signed (so if you need one for the IRS and another for the State of Florida, you would be charged for two POAs). It's also important to note that good accountants aren't charging you to "make another buck." They're doing it to cover their time and effort. They also should be listing three years back and three years forward (the maximum typically allowed by the IRS) as the authorization period on the POA. Doing this means if another matter comes up, they don't need to ask you to sign another POA (and thus charge you again). Having an authorized, knowledgeable professional in your corner can be priceless when it comes to tax matters.

The bottom line

A POA is a powerful tool that enables your accountant to handle your tax affairs, reducing the stress and complexity of dealing with tax authorities. Despite the initial cost of preparation, remember that the experience and knowledge of a professional accountant is invaluable. They don't just fill out forms, they offer strategic advice and protect your interests, so it's an investment that can save you time, stress, and potentially even money in the long run. Always ensure that your POA is correctly prepared and keep an open line of communication with your representative. Remember, your tax matters are important, so they deserve the vigilant and knowledgeable attention that a professional can provide.

Do you have tax-related issues you’ve been putting off solving? We can help. Schedule a call with the tax experts at DiMercurio Advisors!