Depreciation is accounting's acknowledgment that business assets lose value over time. Your delivery truck will not be worth the same five years from now. Your computer systems will become outdated. Your manufacturing equipment will wear down. Rather than recording the entire cost upfront, depreciation spreads that expense across the asset's useful life.

Why Should This Matter to You?

Two critical reasons:

- Financial Reporting Accuracy—Depreciation provides a clearer picture of your business performance. Proper depreciation gives potential investors or lenders confidence in your financial reporting when they review your books.

- Tax Savings – Strategic depreciation planning can substantially lower your taxable income. With recent changes in tax laws, the opportunities are better than ever.

Should you buy that equipment in December or January? The tax implications could differ by thousands of dollars. Do you qualify for Section 179 deductions? You might write off the entire purchase immediately under the right circumstances.

Throughout this article, we'll walk you through everything you need to know about depreciation without the accounting jargon. You'll discover which assets qualify, when immediate write-offs make sense, and how to leverage tax rules to keep more money in your business.

*** UPDATE: This page has been updated for the passing of the One Big Beautiful Bill Act. ***

What are the tax implications of depreciation?

Depreciation directly impacts what business owners owe the IRS by reducing taxable income. For example, if a business earned $100,000 and claimed $15,000 in depreciation, it would only be taxed on $85,000.

The timing of depreciation claims significantly affects your tax picture. The IRS has specific rules about depreciation methods and recovery periods for different types of assets. Choosing correctly maximizes tax benefits while making mistakes could lead to penalties or missed deductions.

Tax vs. Book Depreciation

A critical distinction is understanding that tax depreciation differs from book depreciation. Businesses may use straight-line depreciation for financial statements while opting for an accelerated method for tax purposes. The IRS allows this difference, which can optimize both financial reporting and tax savings.

Proper record-keeping is essential for maximizing depreciation benefits. The IRS requires detailed documentation of all depreciable assets, including purchase dates, costs, and depreciation methods. Without these records, businesses risk having deductions disallowed during an audit.

What qualifies as an asset for depreciation?

Not everything your business purchases qualifies for depreciation. For an asset to qualify, your business must own it and use it in business operations, and the asset must have a determinable useful life exceeding one year. Additionally, the asset must gradually wear out, decay, or become obsolete over time. The amount subject to depreciation (called "basis") is typically the asset's purchase price plus related costs.

Common depreciable assets include equipment and machinery, business-use vehicles, office furniture and fixtures, buildings (but not the land they sit on), computers, and technology systems. Intangible assets like patents and copyrights depreciate differently through a process called amortization.

Land never depreciates for tax purposes. Inventory held for sale, assets used primarily for personal purposes, investments, or items with a useful life of less than one year cannot be depreciated. Minor repairs or maintenance costs should be deducted immediately in the year they occur rather than depreciated over time.

Can I write off a new asset immediately?

The short answer: it depends. Some assets qualify for an immediate deduction, while others must be depreciated over several years. Under standard depreciation rules, an asset's cost is spread over its useful life—which can be 5, 7, 15, or even 39 years, depending on the asset type. However, the tax code provides accelerated deduction methods that allow businesses to write off significant portions—or even the full cost—of qualifying assets upfront.

- Section 179 Deduction Allows eligible businesses to deduct the full purchase price of qualifying assets in the year they're placed in service. For 2025, the deduction limit is $2,500,000, phasing out when total qualifying purchases exceed $4,000,000. This applies to new and used business equipment, vehicles, and specific building improvements.

- Bonus Depreciation For 2024, businesses can deduct 60% of an asset's cost in the first year. For assets placed in service from January 1 through January 19, 2025, businesses can deduct 40% of the cost, but from January 20, 2025 onward, the bonus depreciation rate goes back up to 100%. Unlike Section 179, bonus depreciation can create a net operating loss, making it useful for businesses with fluctuating income.

- De Minimis Safe Harbor Election Businesses can immediately expense purchases costing less than $2,500 per item ($5,000 if they have applicable financial statements). This is ideal for small-ticket items like office supplies, tools, and minor equipment.

ExampleA $50,000 equipment purchase could qualify for an immediate $50,000 deduction under Section 179. At a 22% tax rate, this could reduce the business's tax liability by $11,000 in the current year.

|

The decision between immediate expensing and depreciation depends on your business's current and projected income, cash flow needs, and long-term tax strategy.

What's the difference between expensing and depreciation?

Understanding the distinction between expensing and depreciation is crucial for tax planning. While both methods reduce taxable income, they follow different rules and impact cash flow differently.

Expensing: Immediate Deduction

Expensing allows you to deduct the full cost of an asset in the year of purchase. This method is typically used for smaller purchases or when tax provisions like Section 179 allow for the immediate deduction of larger items. When you expense an asset, you're telling the IRS, "I want my tax deduction now," boosting short-term cash flow.

Depreciation: Spreading Costs Over Time

Depreciation allocates an asset's cost over multiple years, reflecting its declining value and long-term use. Instead of taking a full deduction upfront, you claim a portion of the cost each year based on the asset's IRS-assigned useful life. This method matches the expense with the revenue generated by the asset.

ExampleA $5,000 computer system. If expensed, you deduct the full $5,000 in the year of purchase. If depreciated using a 5-year straight-line method, you deduct $1,000 per year for five years.

|

The best approach depends on your financial strategy. If your business is highly profitable this year, immediate expensing provides maximum tax savings now. If you expect higher profits in future years, depreciation spreads out deductions, potentially providing more benefits over time.

What is bonus depreciation, and how does it work?

Bonus depreciation allows businesses to deduct a significant portion of an asset's cost in the year it's placed in service—beyond what standard depreciation schedules allow. Unlike Section 179, bonus depreciation automatically applies to eligible assets unless a business elects out and has no dollar limit, meaning it can be applied to large asset purchases without restrictions.

For 2024, businesses can deduct 60% of an asset's cost in the first year. This rate decreases to 40% in the beginning of 2025, but goes back up to 100% starting on January 20, 2025.

To qualify, the asset must be depreciable with a recovery period of 20 years or less, purchased from an unrelated party, new or used (as long as it's new to the buyer), and placed in service during the applicable tax year.

Unlike Section 179, bonus depreciation has no income limitation—it can be claimed even if it results in a net operating loss. It applies automatically by default, whereas Section 179 requires an election.

If your business is in a growth phase with lower current profits but expects higher future income, opting out of bonus depreciation in favor of regular depreciation may be more beneficial, preserving deductions for years when your tax rate will be higher.

What is the Section 179 deduction, and how does it relate to depreciation?

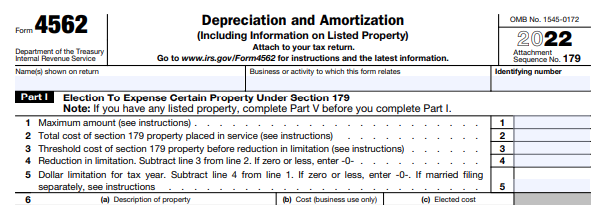

Section 179 allows businesses to deduct the full cost of qualifying equipment and software in the year of purchase rather than spreading the deduction over several years. For 2025, businesses can claim a maximum deduction of $2,500,000, phasing out when purchases exceed $4,000,000.

Unlike bonus depreciation, Section 179 requires businesses to elect it on their tax return and provides flexibility in choosing which assets to apply it to. Your total Section 179 deduction cannot exceed your business's taxable income for the year (though unused amounts can be carried forward).

Qualifying property includes most tangible business equipment, off-the-shelf software, and certain improvements to non-residential buildings. For vehicles, those over 14,000 lbs. qualify for the full deduction, while lighter vehicles are limited to $31,300 (if over 6,000 lbs.) and $20,400 (if under 6,000 lbs.) in 2025.

One of Section 179's biggest advantages is its flexibility—businesses can choose which assets to deduct immediately and which to depreciate over time. Additionally, Section 179 and bonus depreciation can be used together: apply Section 179 to selected assets and use bonus depreciation for additional assets.

How do I calculate depreciation for my business?

Businesses can choose from several methods for calculating depreciation, each offering distinct advantages depending on the asset type and business goals.

- Straight-Line Depreciation (Simple & Predictable) The straight-line method evenly distributes the asset's cost over its useful life. For example, a $10,000 piece of equipment with a 5-year useful life would be depreciated at $2,000 per year ($10,000 ÷ 5).

- Accelerated Depreciation (Larger Deductions Upfront) For assets that lose value more quickly in the early years, accelerated depreciation methods provide larger upfront deductions. The Modified Accelerated Cost Recovery System (MACRS) is the standard IRS-approved method for tax purposes, assigning higher deductions in the earlier years.

IRS Recovery Periods for Common Business Assets

The IRS assigns specific recovery periods based on asset type: Computers and office Equipment (5 years), Furniture and fixtures (7 years), Most Machinery and equipment (5 or 7 years), Commercial Buildings (39 years), and Residential Rental Property (27.5 years).

Most accounting software can automatically calculate depreciation, generate schedules, and update financial reports. Selecting the right depreciation method for your business assets is crucial for tax optimization and accurate financial reporting.

Are there resources to help me manage depreciation?

Managing depreciation does not have to be a solo effort. Several resources can simplify the process and help maximize tax benefits.

- Professional Guidance: A qualified accountant familiar with your industry is an invaluable resource. An experienced CPA can help develop strategic approaches to timing asset purchases, select optimal depreciation methods, ensure IRS compliance, and provide audit protection.

- IRS and Government Resources: The IRS website provides detailed guidance on depreciation, including Publication 946: How to Depreciate Property. Section179.org offers up-to-date information on Section 179 deduction limits and qualifying property.

- Industry-Specific Guides: Different industries have unique assets with special depreciation treatments. Businesses in restaurants, manufacturing, construction, and transportation often benefit from sector-specific guidance on asset depreciation rules.

Working with knowledgeable tax professionals who understand both general depreciation principles and your specific industry can transform complex accounting rules into strategic financial advantages.

The bottom line

Throughout this article, we've revealed powerful depreciation strategies that many small business owners overlook. What might initially seem like complex accounting rules can actually become your financial advantage, potentially saving you thousands in taxes and improving your cash flow.

For personalized guidance on optimizing your depreciation strategy, contact DiMercurio Advisors for a tax planning consultation. We'll help you identify which assets qualify for immediate write-offs, determine whether Section 179 or bonus depreciation makes more sense for your situation, and create a comprehensive plan to maximize your tax savings this year and beyond.