Understanding the purpose of a tax form or schedule is never a pleasant experience. That's why we created a comprehensive tax form library, showcasing the most frequently used tax forms and schedules you may encounter. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

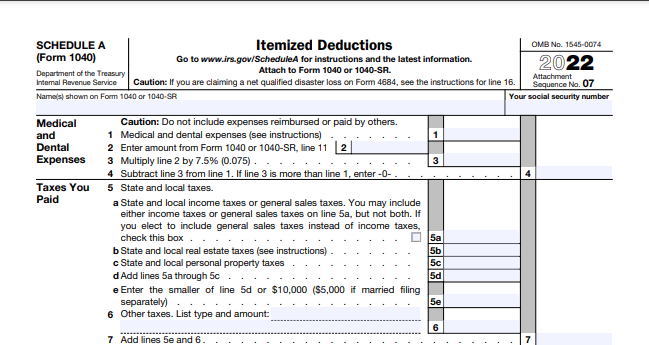

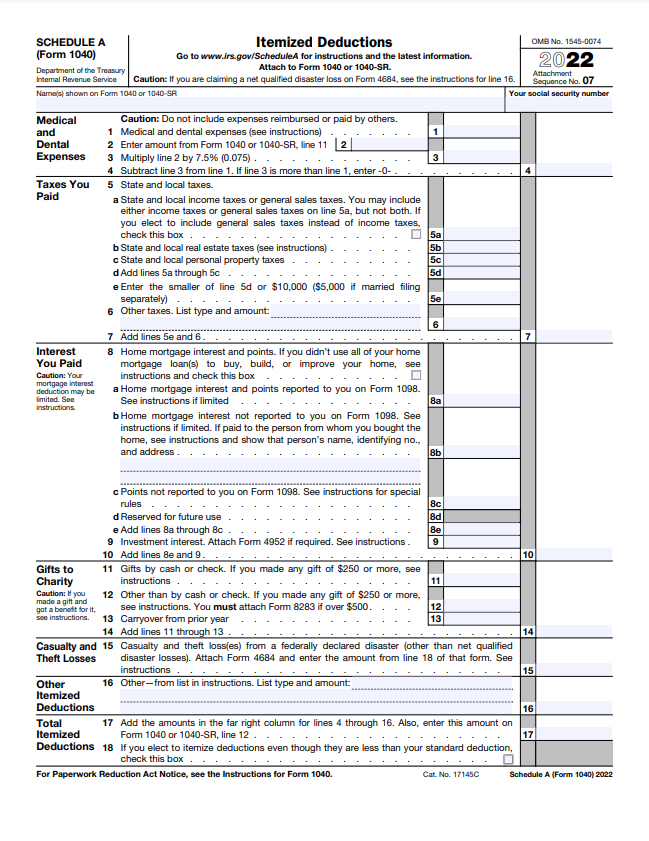

- What is the form number? Form 1040 Schedule A

- What government agency is it filed with? The Internal Revenue Service (IRS)

- What is the form name? Itemized Deductions

- What is this form about? Schedule A is a supplemental form associated with Form 1040 that U.S. taxpayers use to itemize deductions. Instead of taking the standard deduction, taxpayers can choose to itemize their deductions if it provides a greater tax benefit. On Schedule A, individuals can report medical and dental care expenses, taxes paid, interest paid (like mortgage interest), charitable contributions, casualty and theft losses, and certain other miscellaneous deductions. If itemizing is beneficial, the total from Schedule A replaces the standard deduction on the main Form 1040.

What does it look like?

Resources

Looking for more information about this form? Here are some helpful resources:

- About the form - https://www.irs.gov/forms-pubs/about-schedule-a-form-1040

- Example copy of the form - https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

- Form instructions - https://www.irs.gov/pub/irs-pdf/i1040sca.pdf

How can we help you today?

Looking for more information about this or other tax forms? The tax team at DiMercurio Advisors are tax compliance experts. We are passionate about ensuring you are well-informed and in control of your tax situation.