If you’ve ever stared at a health insurance premium and wondered, How is this even affordable? You’re not alone. For many self-employed individuals, small business owners, and freelancers, navigating coverage through the Health Insurance Marketplace can feel overwhelming.

The Advance Premium Tax Credit (APTC) is a key tool designed to make health insurance more affordable. It’s not a loophole or a risky workaround, it’s a built-in benefit of the Marketplace system. Understanding how it works could save you hundreds, or even thousands, dollars each year.

In this guide, we’ll explain what the APTC is, who qualifies, how it affects your taxes, and the important steps to help you stay informed and avoid unwanted surprises.

What exactly is the Advance Premium Tax Credit, and how does it lower my health insurance costs?

The Advance Premium Tax Credit (APTC) is a federal tax credit that helps make health insurance more affordable for individuals and families. Unlike traditional tax credits that you claim after the year ends, the APTC is applied in advance, meaning it immediately lowers the cost of your monthly health insurance premium.

Here’s how it works:

- Upfront savings: Instead of waiting to claim the credit when you file your tax return, the APTC is applied directly to your Marketplace plan each month. This reduces the amount you have to pay out-of-pocket for your coverage.

- Marketplace only: The APTC is only available for health plans purchased through the official Health Insurance Marketplace, such as Healthcare.gov or your state’s Marketplace exchange.

- Flexible application: You can choose to apply some or all of the credit upfront to reduce your monthly costs. Alternatively, you can defer it and claim the full amount when you file your tax return. Most people choose to apply the credit monthly to make coverage more affordable throughout the year.

Using the APTC correctly can significantly reduce your health insurance expenses, but it requires accurate income estimates and regular updates to avoid surprises at tax time.

Am I eligible for the APTC, or am I leaving money on the table?

Many individuals and families who qualify for the Advance Premium Tax Credit don’t realize they are eligible. Understanding the criteria can help you avoid missing out on important savings.

To qualify for the APTC, you must meet all of the following conditions:

- Income guidelines: Your household income generally needs to fall between 100% and 400% of the federal poverty level (FPL). In some years, this range has expanded, so it’s important to check current thresholds.

- No access to affordable employer coverage: You cannot have access to a qualifying, affordable health insurance plan through an employer.

- No eligibility for other public programs: You must not be eligible for Medicare, Medicaid, or the Children’s Health Insurance Program (CHIP).

- Federal tax filing requirement: You must file a federal tax return for the year you receive the credit.

- Marketplace coverage: Your health insurance must be purchased through the official Health Insurance Marketplace.

It’s important to review your eligibility annually. Changes in income, family size, or access to employer-sponsored coverage can affect whether you qualify, and how much credit you are entitled to. Updating your information during open enrollment and any time your circumstances change ensures you maximize your savings and avoid repayment surprises.

How do I actually get and use the APTC—can I just apply it to my monthly premium?

You can apply for the Advance Premium Tax Credit through the Health Insurance Marketplace. Here’s how the process typically works:

- Create an account on the Marketplace website (Healthcare.gov or your state’s exchange).

- Estimate your household income for the upcoming year and provide details about your household size.

- Review your eligibility to see the amount of APTC you qualify for and how it would reduce your monthly premiums.

- Choose how to apply the credit:

- Advance payments apply the credit to your premiums each month, reducing your out-of-pocket cost immediately.

- Year-end credit lets you wait and claim the full credit when you file your federal tax return.

Most people opt for advance payments to make monthly premiums more manageable.

- Advance payments apply the credit to your premiums each month, reducing your out-of-pocket cost immediately.

- Select a Marketplace plan with the credit factored into your premium amount.

| 💵 A note on income estimates: Estimating your income accurately is important, especially if you are self-employed or your earnings fluctuate. Assistance is available through Marketplace navigators: trained, certified professionals who can guide you through the application process at no cost. Seeking help can make the process faster and help you avoid errors that could affect your credit. |

What happens if my income goes up (or down) during the year—will I owe money back?

The Advance Premium Tax Credit is based on your estimated annual income. If your actual income during the year ends up being different, it can affect how much credit you were truly eligible for. Here’s how it works:

- If your income increases:

You may have received more APTC than you were entitled to. In this case, you could be required to repay some or all of the excess when you file your tax return. - If your income decreases:

You might have qualified for a larger credit. You may be eligible for additional savings, which could result in a refund at tax time.

Income changes, shifts in household size, or updates to your filing status can all affect your APTC. Check and update your Marketplace information regularly during the year, especially if your income or household situation changes. Keeping your details current ensures that your monthly premiums remain accurate and helps prevent unexpected repayment obligations later.

How will the APTC affect my tax return, and what is this “reconciliation” I keep hearing about?

Reconciliation sounds intense, but it’s just a fancy way of saying: compare what you got with what you were actually eligible for.

Here’s how the process works:

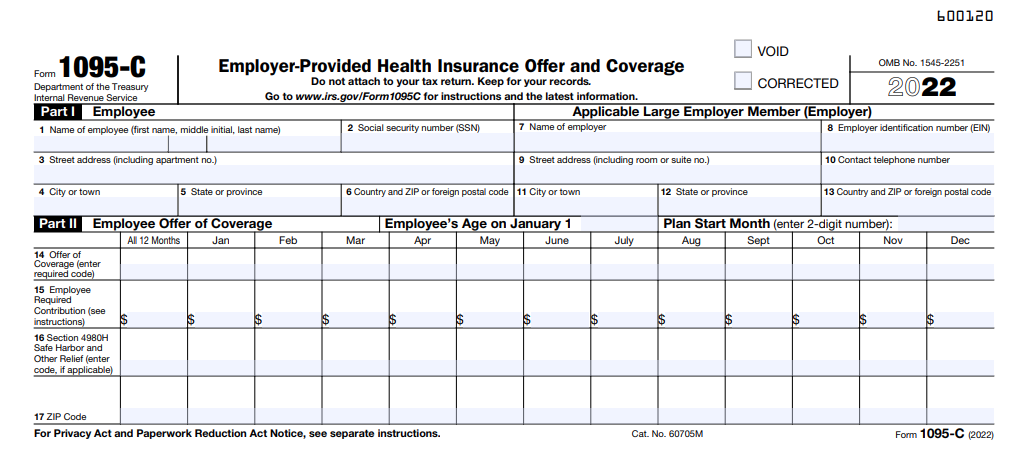

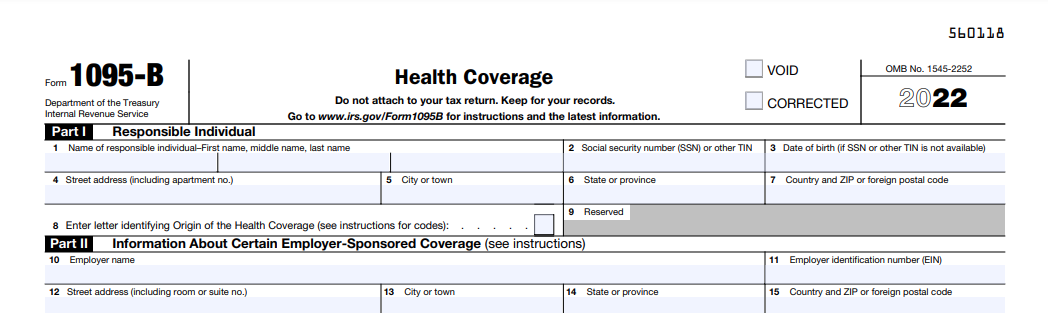

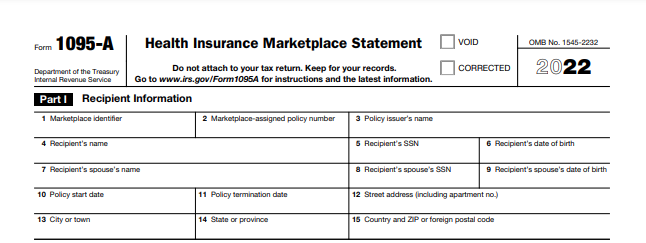

- Form 1095-A: Early in the year, you’ll receive Form 1095-A from the Health Insurance Marketplace. It provides a record of the coverage and APTC you received.

- Form 8962: You’ll complete IRS Form 8962 to compare the amount of credit you received with the amount you were eligible for based on your final income for the year.

Possible outcomes:

- If you received less credit than you were eligible for: You may receive an additional refund when you file your taxes.

- If you received more credit than you were eligible for: You may have to repay part or all of the excess credit. However, the IRS places annual caps on repayment amounts based on your income level.

Reconciling the APTC is a routine part of the tax process for anyone who receives the credit. It’s important to complete this step—failure to reconcile can make you ineligible for APTC assistance in future years.

What should I do to keep my APTC (and avoid headaches down the road)?

Staying proactive helps you maintain your Advance Premium Tax Credit and avoid unexpected issues at tax time. Here are key steps to stay on track:

- Report changes promptly. If your income, household size, or tax-filing status changes during the year, notify the Marketplace as soon as possible.

- Keep clear records. Maintain documentation of any updates you submit and any correspondence you receive from the Marketplace.

- Review your income estimates. Revisit your estimated income during open enrollment and update it anytime your financial situation changes.

- Seek assistance when needed. Certified Marketplace navigators and qualified tax professionals can help you navigate more complex situations and ensure you’re making the right updates.

The system is designed to help, but staying current with your information is key to making the most of the APTC and avoiding unexpected costs.

The bottom line

The Advanced Premium Tax Credit is designed to make health insurance more affordable, not more complicated. But like any tool, it works best when you understand how to use it.

By staying up-to-date on your Marketplace information, reporting changes as they happen, and completing your annual reconciliation, you can maximize your savings, avoid tax-time surprises, and keep your coverage on track.

If you’re unsure about your situation or want to be certain everything is set up correctly, we’re here to help. Schedule a free call with DiMercurio Advisors to get the guidance you need and approach health insurance season with confidence.