Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

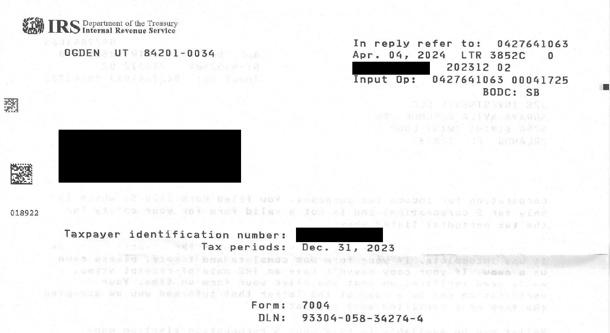

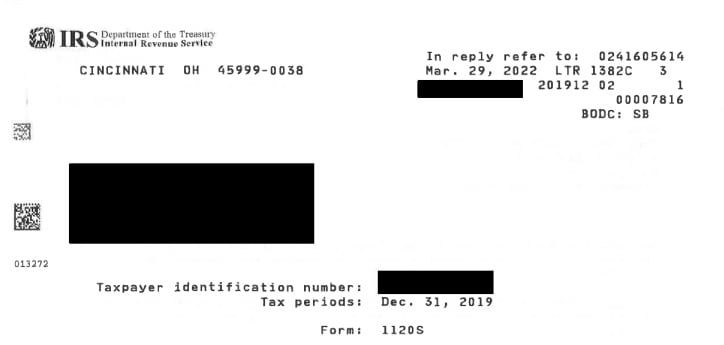

- What is the notice number? LTR3852C

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? This letter was received because the IRS could not process your extension as filed.

- What should you do if you receive this notice? Review your return. Verify the identifying details, such as name and address, as well as the type of return you filed. Update your records with the IRS if any details are inaccurate. If you filed the wrong type of return, make sure to prepare and file the correct one promptly.

FAQs & Additional Information

- What will happen after I provide my response? The IRS will review your response and process your tax return if all discrepancies are resolved. If further clarification is needed, they may request additional documentation. Delays are possible, so monitoring your IRS account for updates is recommended.

- How long do I have to respond to this notice? The letter will most likely provide a specific time frame, but you typically have 30 days from the date of the letter to respond.

- Will I be penalized for filing a late return if I received this notice? If the issue remains unresolved past the filing deadline, you may face penalties or interest.

What does it look like?

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.