Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

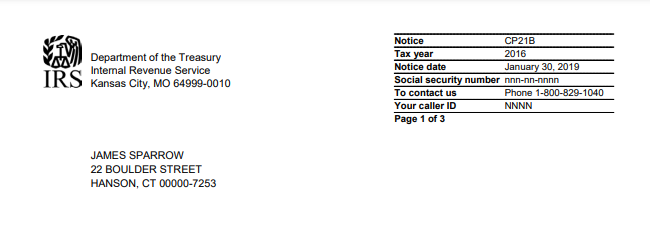

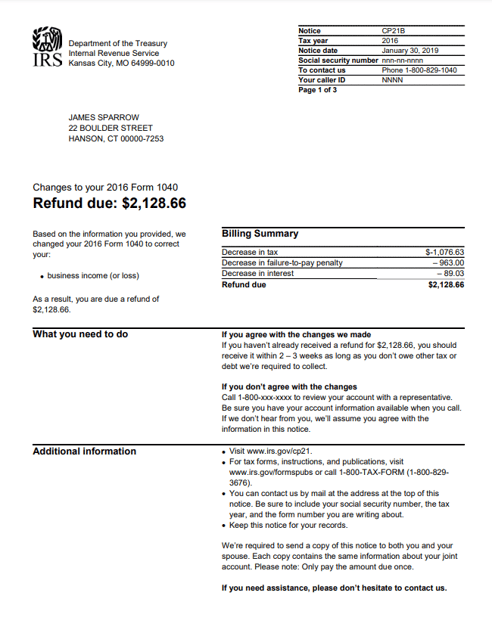

- What is the notice number? CP21B

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? The IRS made the changes you requested to your tax return for the tax year specified on the notice. You should receive your refund within 2-3 weeks of your notice.

- What should you do if you receive this notice?

- Read your notice carefully to see what the IRS changed.

- Contact the IRS if you disagree with the changes they made.

- Correct the copy of your tax return that you kept for your records.

- Be sure to report any interest the IRS paid you on your tax return for this year.

FAQs & Additional Information

- What if I don't receive my refund in 2-3 weeks? If you don't owe other taxes or debts the IRS is required to collect, such as child support, and 3 weeks have lapsed, call them at the toll-free number listed on the top right corner of your notice.

- Will I receive information about the interest that I need to report on my next tax return? If you receive $10 or more in interest, you'll receive a Form 1099-INT, Interest Income, by January 31 of next year. Please note, even if the interest you receive is less than $10, you must report this amount on your tax return.

- I don't remember sending a request to IRS to change my return. How can I find out what IRS received to initiate this change? Call the IRS at the number listed on the top right corner of your notice.

- What if I need to make another correction to my account? You'll need to file Form 1040X, Amended U.S. Individual Income Tax Return.

- What if I haven't gotten answers after contacting IRS several times? Call the Taxpayer Advocate at 877-777-4778 or for TTY/TDD 800-829-4059.

- What if I think I'm a victim of identity theft? Call the IRS at the number listed on the top right corner of your notice.

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp21b-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp21b_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.