Receiving a tax notice or letter is never a pleasant experience. It can be confusing and frustrating if you don't understand why you received the notice in the first place. That's why we wrote The Ultimate Guide to Tax Notices and created a tax notice library filled with the most common tax notices and letters you might receive. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

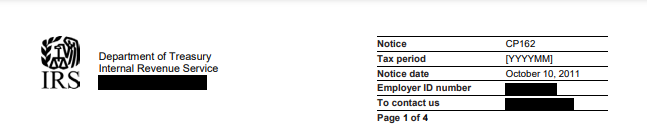

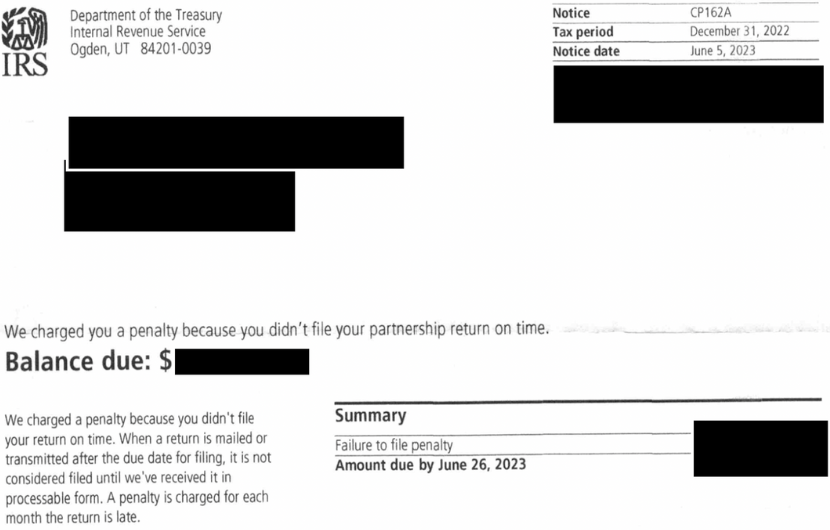

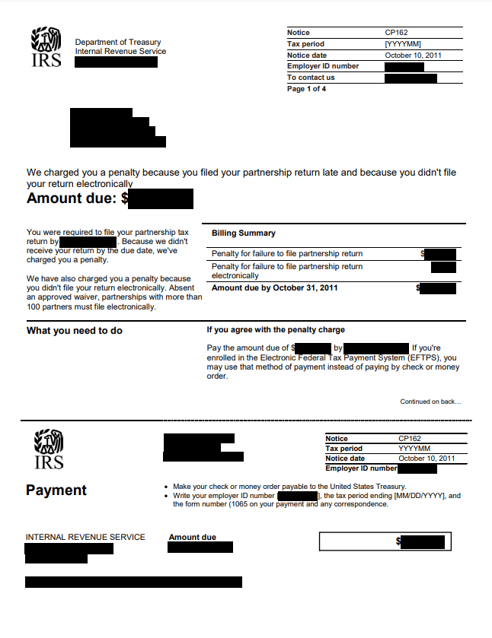

- What is the notice number? CP162

- What government agency sends this notice? The Internal Revenue Service (IRS)

- What is this notice about? The IRS charged you a penalty because you didn't file your return electronically, as required.

- What should you do if you receive this notice?

- If you agree with the penalties, mail your full payment to the IRS by the date shown on your letter to avoid additional interest charges.

- If you think the IRS incorrectly charged a penalty and you meet any of the criteria below, an authorized officer or partner can call the IRS at 800-829-0922 to discuss the account.

FAQs & Additional Information

- What information am I required to include in the return? If it’s listed in the instructions for the return as required information, you must include it.

- What if I can’t get the missing information, due to no fault of my own? If you can’t get the missing information, you can submit a written explanation and ask for a waiver of the penalty for reasonable cause.

- Who can call the IRS about this notice?

- In the case of a small partnership that hasn’t designated a partnership representative, any partner can call the IRS. Otherwise, only the partnership representative or someone who the partnership representative authorizes using Form 2848, Power of Attorney and Declaration of Representative.

- In the case of a corporation, any corporate officer authorized to bind the corporation with his or her signature or anyone who the corporation’s chief officer authorizes using Form 2848 may call.

What does it look like?

Resources

Looking for more information about this notice? Here are some helpful resources:

- About the notice - https://www.irs.gov/individuals/understanding-your-cp162-notice

- Example copy of the notice - https://www.irs.gov/pub/notices/cp162_english.pdf

How can we help you today?

Are you looking for more information about your tax notice or other challenges? DiMercurio Advisors has a dedicated team supporting tax notices, audits and more. We are passionate about ensuring you are well-informed and in control of your tax situation.