Find out how much you can save by simply keeping your employees on payroll during COVID-19.

To help businesses retain employees and keep them employed during the COVID-19 crisis, Congress has provided a refundable Employee Retention Credit available to all qualifying employers regardless of size, including tax-exempt organizations.

To qualify for the credit, employers must fall into one of two categories:

- Their business operations were curtailed: Eligible employers who were carrying out a trade or business during 2020, and the operation of that business is fully or partially suspended due to orders from an appropriate government authority limiting commerce, travel, or group meetings due to the COVID-19 outbreak.

- Their gross receipts declined 50 percent: Eligible employers have gross receipts that are less than 50 percent of their gross receipts for the same quarter in 2019. Employers remain eligible until their gross receipts exceed 80 percent of their gross receipts for the same 2019 calendar quarter.

However, an employer who secures an SBA Paycheck Protection Loan created by the CARES Act is ineligible for the Employee Retention Credit. A Paycheck Protection Loan can be forgiven for wages paid during an eight-week period, which leads to double dipping on CARES Act benefits if the business tries to use both benefits.

The Employee Retention Credit is a refundable payroll tax credit for 50 percent of qualified wages up to a maximum wage of $10,000 per employee. Wages taken into account are those paid starting March 13, 2020 through Dec. 31, 2020 and include a portion of the cost of healthcare provided by the employer. No credit is available with respect to an employee in any period for which the employer is allowed a Work Opportunity Credit for that employee.

Qualifying wages are based on the average number of a business’ employees in 2019. These are the two possible scenarios:

- Employers with 100 or fewer employees: If the employer had 100 or fewer employees on average in 2019, the credit is based on wages paid to all employees, regardless of whether they worked. If the employees worked full-time and were paid for full-time work, the employer still receives the credit.

- Employers with more than 100 employees: An employer that had more than 100 employees on average in 2019 is allowed a credit only for wages paid to employees who did not work during the calendar quarter.

Wages do not include amounts for payroll credits provided for required paid sick leave or required paid family leave for which the government is reimbursing the employer.

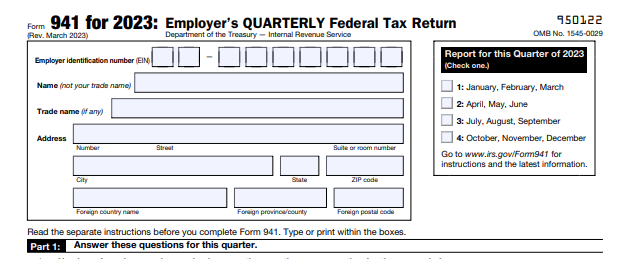

Employers can be reimbursed for the credit immediately by reducing their required deposits of payroll taxes withheld from employees’ wages by the amount of the credit.

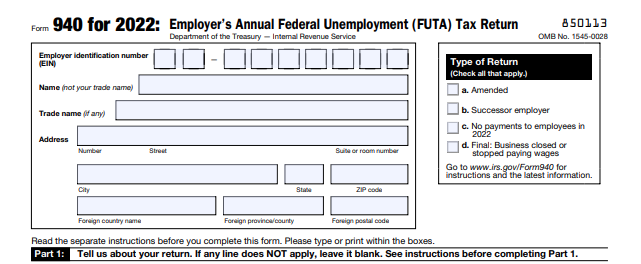

Eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their quarterly employment tax returns or Form 941 beginning with the second quarter of 2020. If the employer’s employment tax deposits are not sufficient to cover the credit, the employer may receive an advance payment from the IRS by submitting Form 7200.

The bottom line

Employers must carefully consider which tax benefit or combination of tax benefits works best for their particular set of circumstances, particularly the choice between the Employee Retention Credit and the SBA Paycheck Protection Loans, since a business cannot qualify for both.

Learn more about the latest COVID-related financial updates.