Understanding the purpose of a tax form or schedule is never a pleasant experience. That's why we created a comprehensive tax form library, showcasing the most frequently used tax forms and schedules you may encounter. We believe the process of staying compliant with your taxes should be as effortless as possible.

General Information

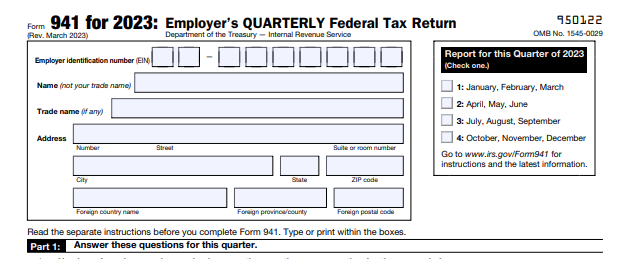

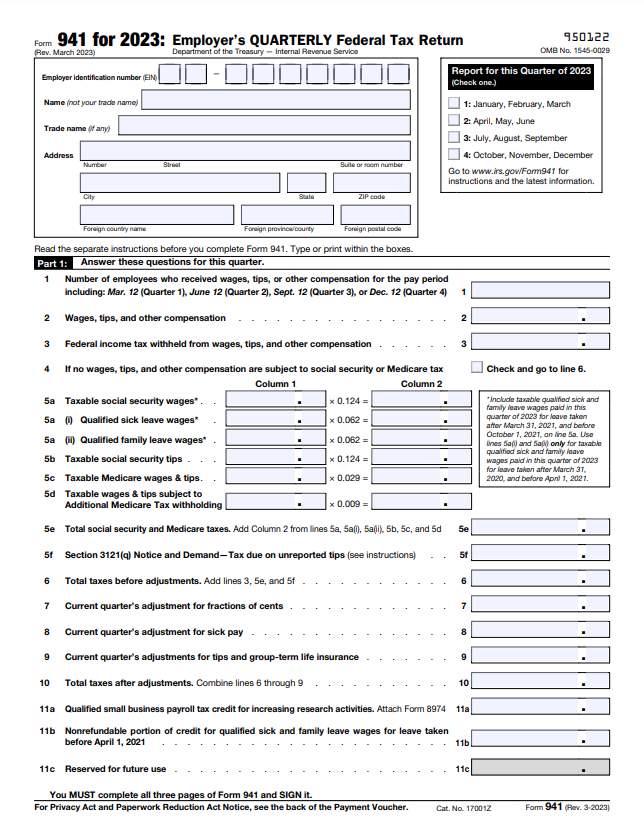

- What is the form number? Form 941

- What government agency is it filed with? The Internal Revenue Service (IRS)

- What is the form name? Employer's Quarterly Federal Tax Return

- What is this form about? Form 941 is a quarterly form used by employers to report wages paid, tips employees received, federal income tax withheld, and both the employer's and employee's share of Social Security and Medicare taxes. It ensures that employers are correctly withholding and remitting these amounts on behalf of their employees.

What does it look like?

Resources

Looking for more information about this form? Here are some helpful resources:

- About the form - https://www.irs.gov/forms-pubs/about-form-941

- Example copy of the form - https://www.irs.gov/pub/irs-pdf/f941.pdf

- Form instructions - https://www.irs.gov/pub/irs-pdf/i941.pdf

How can we help you today?

Looking for more information about this or other tax forms? The tax team at DiMercurio Advisors are tax compliance experts. We are passionate about ensuring you are well-informed and in control of your tax situation.